No new tax for the rich, FPIs lead to 2,300-point Sensex salute for Budget

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

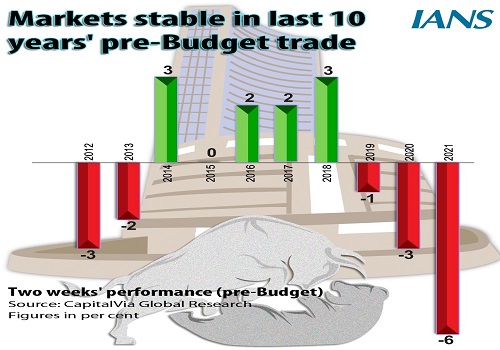

The stock markets have saluted the Union Budget with a massive gain of 2,300 points as the fears of a Covid cess or increase in capital gains tax did not materialise while withholding tax for FPIs found no mention.

Nitesh Mehta, Partner (transaction tax), BDO India, said the Finace Minister's clarification on tax withholding on dividend payment to FPIs to be done after considering the tax treaty benefits is a welcome move as the current law is silent on this aspect.

The BSE Sensex, which was in the green since the morning, was trading at 48,567 points, up by 2,300 points or 4.95 per cent.

Narendra Solanki, Head, Equity Research (Fundamental), Anand Rathi Shares and Stock Brokers, said that during the afternoon session, the markets reacted positively to the Union Budget.

On sectoral front, almost all the sectors were trading in green post the Budget presentation, except pharma which was trading in the red, he added.

Motilal Oswal, MD and CEO, Motilal Oswal Financial Services, said that the FY22 Budget has been much better than the market's expectations. The feared and anticipated measures around Covid cess/higher capital gains tax/wealth tax. etc did not materialise. This will provide a huge relief to the market and the economy and help to sustain the buoyant sentiments in the economy.

Oswal said the government has clearly articulated the focus towards infra and capex spending with five key measures. "We believe this will push capex spending in the economy and augur well for the overall economic revival of India. The significant increase in allocation to the healthcare sector should lift the general well-being in the economy," he added.

Oswal added that Finance Minister Nirmaqla Sitharaman has also announced several measures for relaxation of compliance and procedural burdens in multiple spheres of activities (taxation being the most prominent).

Devang Mehta, Head, Equity Advisory, Centrum Broking, said this is surely an expansionary budget with a vision to spur capex, infrastructure and healthcare spending.

"The way forward for divestment, privatisation and asset monetisation looks promising. Going with a sharp correction into the budget, the street was enthused by the absence of negatives and an attempt to be focused on robust growth for the key sectors and in turn boost economic growth," he added.

Mehta said the market cheer was also led by an underlying pessimism over raising tax rates or taxing the super rich, which was prevailing in the market for the last couple of weeks.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">