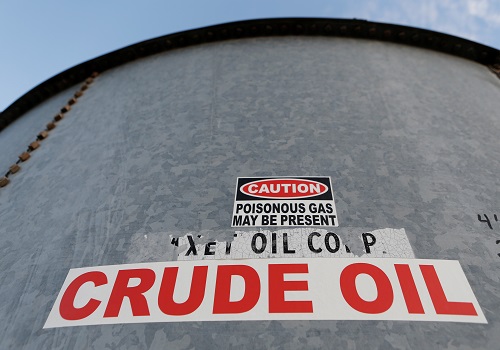

Oil steady as market eyes Middle East tensions, higher US crude stockpiles

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Oil prices were little changed on Thursday as the market weighed mixed drivers, eyeing tensions in the Middle East while digesting a rise in U.S. crude stockpiles.

Brent crude futures dipped 3 cents to $90.10 a barrel at 0100 GMT, while U.S. West Texas Intermediate crude futures eased 3 cents at $85.36 a barrel.

The benchmark oil contracts have settled nearly 2% higher on Wednesday, buoyed by persisting worries about the Middle East conflict.

But prices lacked clear direction on Thursday as investors considered a rise in U.S. crude inventories, indicative of weak drawdown and demand.

U.S. crude inventories climbed by 1.4 million barrels in the latest week to 421.1 million barrels, according to the Energy Information Administration, exceeding a 240,000-barrel gain expected by analysts from a Reuters poll.

"Markets remain volatile as Middle East jitters ebb and flow, but underlying fundamentals are seasonally weaker than expected with product demand in the U.S. surprisingly weak," Citi analysts said on Thursday.

Refinery crude runs in the U.S. fell by 207,000 barrels per day, while refinery utilisation rates also edged lower by 0.5 percentage point to 85.6% of total capacity, showed EIA data.

Investors are expected to continue keeping tabs on developments in the Middle East, amid fears that any escalation would roil oil markets and disrupt supplies.

Israel has agreed to delay an expected invasion of Gaza for now, according to a report, so that the United States can rush missile defences to the region to protect U.S. troops there.

Meanwhile, macroeconomic concerns continued to weigh on the outlook for oil demand, as euro zone business activity data took a surprise downturn this month.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">