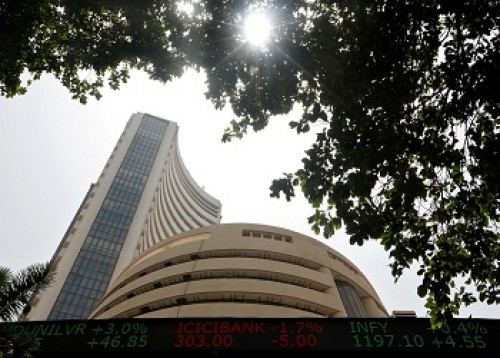

Budgetary hopes, Q3 earnings to chart equities` course (Market Outlook)

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Global cues along with domestic quarterly earning results and progress of the vaccine rollout programme will determine the trajectory of the Indian equities markets during the coming week.

Besides, volatile is expected to rise in the run-up to the Union Budget FY22 and high value proposition.

"The Nifty has given the first signs of reversing after a steep rise. Deteriorating advance decline ratio has also raised concerns over the last few days of the possibility of a formation of a short term top. 14,653-14,215 points are supported for the Nifty for the coming week," said Deepak Jasani, Head of Retail Research at HDFC Securities.

"Stock specific moves will continue based on results and other developments."

The week ahead will be heavily influenced by Q3FY21 corporate earnings as companies like Asian Paints, HDFC Bank, Mindtree, Hindustan Zinc and Mphasis are expected to announce their quarterly results.

"Banking and Finance sector will be in focus as major Banks and NBFCs are to release their quarterly results," said Geojit Financial Services' Head of Research Vinod Nair.

"The market can be volatile going forward, including concerns over the Union Budget. We suggest investors consider partial profit booking," said Nair.

According to Siddhartha Khemka, Head, Retail Research, Motilal Oswal Financial Services: "Next week, we would see a lot of macro data getting announced along with ECB, BoJ and PBoC interest rate decisions."

"As the long term market structure remains positive, we advise investors to adopt the 'Buying on Dips' strategy to accumulate quality stocks. Traders on the other hand should book profits intermittent."

Additionally, the coming week will witness the swearing-in of the new US President and some of the policy announcements of the new administration.

"The markets expect larger and more generous quantitative easing which will pave the way for more money in the hands of the people," said Joseph Thomas, Head of Research, Emkay Wealth Management.

"Domestic markets will have their sights focussed on the earnings results which has started trickling in, and which will assume a faster pace as weeks pass by. More than anything else, some of the expectations from the budget too may start getting priced in as we move into the next week."

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">