Nifty breached intermediate support of 17800 and extended corrective phase over third session - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: 17757

Technical Outlook

• Contrary to our expectation, Nifty breached intermediate support of 17800 and extended corrective phase over third session in a row. The daily price action formed a bear candle, indicating continuance of corrective bias. In the process, index approached 38.2% retracement of December-January rally (16410-18350)

• Historically, within major rallies to the tune of measuring 30% up move, the intermediate corrections have been arrested within 38.2% retracement of respective rally. Looking at 22 months history, we don’t expect Nifty to retrace more than 38% of past one month rally (16400-18350). Thereby, in current scenario we expect 17600-17400 zone would act as key support that coincides with 100 days EMA placed at 17382. Hence, extended breather from here on should not be construed as negative. Instead, dips should be capitalised on as an incremental buying opportunity to ride the next leg of up move

• The broader market endured its relative outperformance as Nifty midcap, small cap settled marginally lower, despite extended sell-off in the benchmark. We believe, ongoing breather would make broader market healthy and gradually help them to accelerate relative outperformance in coming weeks

• Structurally, the formation of higher peak and trough on the larger degree chart signifies broader positive structure. The secondary correction is part of the secular bull market that paves the way for next leg of rally. In current scenario, we expect ongoing corrective move to find its feet around 17600- 17500 as it is confluence of: a) 38.2% retracement of December-January rally (16410-18350) b) The 100 days EMA is placed at 17382

In the coming session, the index is likely to open on a subdued note tracking weak global cues. The formation of lower high-low signifies corrective bias. Hence intraday pullback towards 17775-17802 should be used to create short position for target of 17686

NSE Nifty Daily Candlestick Chart

Nifty Bank: 37850

Technical Outlook

• The price action resulted in a bear candle with lower high - low indicating extended profit booking as index breached 38000 mark as profit booking emerged from 38850 after 4000 points rally over past one month led prices into overbought trajectory . For upward momentum to resume index needs to form higher high -low on sustained basis

• Going forward, our over all structural positive stance on BankNifty remains intact with broader target of 40000 , which is the 80 % retracement of the entire decline (41829 - 34018 )

• Index has resumed its uptrend after 20 % correction during November -December 2021 . In early January 2022 index resolved out of falling channel signaling end of corrective phase . Further relative ratio of BankNifty/Nifty has also resolved above falling trend line indicating outperformance by Banking index in coming weeks, as anxiety around impact of third covid wave subsided . Therefore, any breather in coming week should not be construed negative rather would offer incremental buying opportunity as we enter the Q 3 earnings season . Buying the decline strategy should work well in coming earnings season as we expect BankNifty index to hold strong support of 37500 levels being the confluence of the following technical observations :

• (a) 23 . 6 % retracement of the current up move (34018 - 38851 )

• (b) the recent breakout area is placed around 37500 levels In the coming session, the index is likely to open on a subdued note tracking weak global cues . The formation of lower high -low signifies corrective bias . Hence intraday pullback towards 37775 -37845 should be used to create short position for target of 37522 , maintain a stop loss of 37962

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

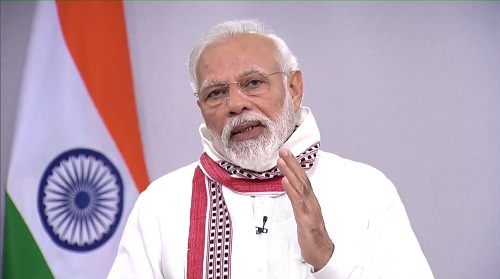

Breaking News - Prime Minister Narendra Modi To address CoWIN Global Conclave at 3 pm today

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Market Quote : Investors are adopting buy on dip strategy, refocusing on quarterly earnings ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">