Neutral Alkyl Amines Ltd For Target Rs.3,025 - Motilal Oswal Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

New capacity additions to drive volume growth

* AACL reported lower-than-estimated revenue. Gross margin contracted in 2QFY23 to 49% (down 190bp QoQ). Some raw material prices have started falling, which would help improve margins. EBITDA also came in below our estimate at INR813m with EBITDAM at 19.9% (down 460bp QoQ).

* Capacity expansion of Ethyl Amines in Kurkumbh (100tpd capacity) is on track and is expected to be commissioned by May/Jun’23, with mechanical completion planned in Apr’23. Capex envisaged for the same is INR4b.

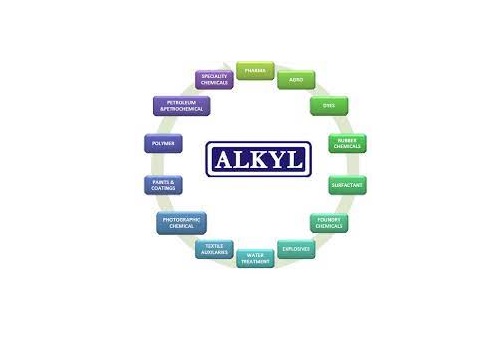

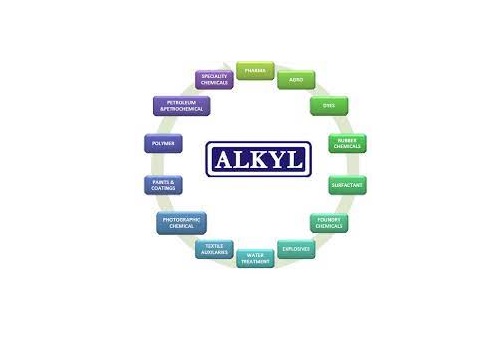

* AACL also announced that it would be manufacturing four to five new products in the specialty segment, which would be developed in its own R&D labs. The new products are expected to execute import substitution play. The company expects peak revenue of INR 7-8b from these products (market opportunity is much greater) over the next three to four years. One of the products is expected to start by end-Dec’22.

* The long-term guidance of 10-15% volume growth remains intact with the growth expected to be less than 10% in FY23, given the ensuing challenges. The management believes it can defend its margins in FY23 but it would be difficult to provide any guidance as such.

* AACL’s ROE is estimated to improve to 29% for FY24 from 25% in FY22. The stock is trading at 38x FY24E EPS and 26x FY24E EV/EBITDA. We reiterate our Neutral rating on the stock, and value it at 40x FY24E EPS to arrive at a target price of INR3025. EBITDA and margin missed

EBITDA and margin missed estimates

* AACL’s 2QFY23 revenue was at INR4.1b (up 17% YoY, down 14% QoQ).

* Gross margin contracted QoQ and was at 49%. EBITDAM stood at 19.9% (v/s ~24.5% in 1QFY23).

* EBITDA came in at INR813m (est. of INR1.1b; up 8% YoY, down 30% QoQ). PAT stood at INR524m (est. of INR756m, down 3% YoY, down 36% QoQ).

* AACL announced that it is setting up plants for adding new products in both specialty chemicals and amine derivatives businesses (capacity of 25-30ktpa) at its existing facilities at Kurkumbh and Dahej.

* This is considering the growing demand for the company’s products in the domestic market and to increase its product base.

* Capex to be undertaken would be to the tune of INR2-2.5b (funded by internal accruals) with plants getting set up over the next 3-24 months.

* For 1HFY23, revenue was at INR8.8b (up 19% YoY), EBITDA was at INR2b (up 6% YoY), and PAT was at INR1.3b (flat YoY).

* EBITDAM contracted to 22.3% YoY (v/s 25.2% in 1HFY22).

Valuation and View

* Ongoing expansions will boost aliphatic amines capacity by ~30% (capex: INR4b, with completion expected by 1HFY24). The current capacity stands at 90-100ktpa for aliphatic amines. Entry into new specialty products could also boost margins as management sees strong demand for these products.

* We forecast a ~20% revenue CAGR over FY22-24, with an EPS CAGR of 31% over the same period. Downside risks to our call could be increased competition, wherein the market price is determined by the competitor with little pricing power left for AACL to command.

* We reiterate our Neutral rating on the stock, and value it at 40x FY24E EPS to arrive at a target price of INR3025.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">