Neutral Alkyl Amines Chemicals Ltd For Target Rs.2,400 - Motilal Oswal Financial Services Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

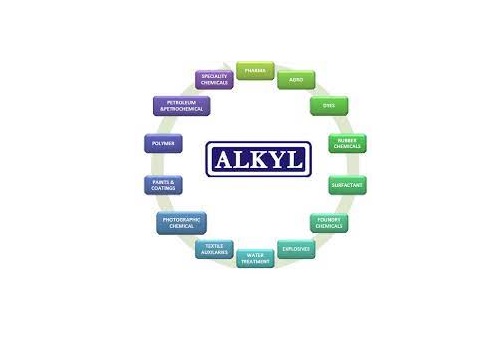

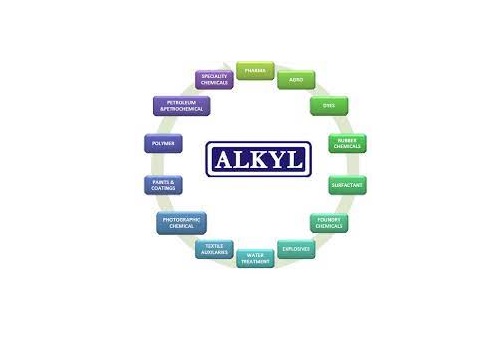

* Alkyl Amines (AACL) reported in-line revenue in 4QFY23. Gross margin contracted to 46.4%. EBITDA was also in line at INR769m with EBITDAM at 18.7% (+80bp QoQ). Operating expenses were higher due to elevated coal prices even as the company was able to maintain its market share in FY23.

* The pharma industry outlook appears positive after a couple of years of drag post-Covid due to de-stocking on account of inventory buildup during the pandemic. That being said, the management focus and long-term guidance of 10-15% volume growth remained intact.

* The average utilization of both the ACN plants was 60-65% in FY23 with current realizations being INR150/kg. In USD terms, it is one of the lowest values right now due to a glut in the market but the management expects the prices of ACN to rebound in FY24.

* Capacity expansion of Ethyl Amines in Kurkumbh (100tpd capacity) is on track and is expected to be commissioned by Jul’23. Capex envisaged for the same is INR4b. The company had also commissioned Di-Ethyl Ketone in Feb’23, the plant of which has now stabilized with other four products set to be commissioned in the next 24 months.

The stock is trading at 32x FY25E EPS and 22x FY25E EV/EBITDA. We reiterate our Neutral rating on the stock, and value it at 30x FY25E EPS to arrive at our TP of INR2,400.

EBITDA in line; EBITDAM expands

* AACL’s revenue stood at INR4.1b (est. INR4b, down 3% YoY, up 6% QoQ).

* Gross margin was at 46.4% with EBITDAM at 18.7% (v/s ~17.9% in 3QFY23).

* EBITDA was at INR769m (est. INR768m, up 5% YoY, up 11% QoQ) in 4QFY23.

* PAT stood at INR486m (est. INR512m, up 5% YoY, up 6% QoQ), primarily due to higher-than-estimated tax during the quarter.

* For FY23, revenue was at INR16.8b (up 9% YoY), EBITDA was at INR3.4b (up 5% YoY) and PAT stood at INR2.3b (up 2% YoY). ? EBITDAM contracted to 20.4% (down 70bp YoY).

* The Board has declared a final dividend of INR10/sh for FY23.

Valuation and View

* Ongoing expansions will boost aliphatic amines capacity by ~30% (capex of INR4b, with completion expected by 2QFY24). The current capacity stands at 90-100ktpa for aliphatic amines. Entry into new specialty products is also likely to boost margins as the management sees strong demand for these products, which are a mix of amine derivatives and specialties.

* We forecast an ~18% revenue CAGR over FY23-25, with an EPS CAGR of 22% over the same period. Downside risks to our call could be intensified competition, wherein the market price is determined by the competitor with little pricing power left for AACL to command.

* The stock is trading at 32x FY25E EPS and 22x FY25E EV/EBITDA. We reiterate our Neutral rating on the stock, and value it at 30x FY25E EPS to arrive at our TP of INR2,400.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">