MCX gold prices traded flat on Tuesday due to weakness in US dollar index - ICICI Direct

Bullion Outlook

* MCX gold prices traded flat on Tuesday due to weakness in US dollar index

* Further, precious metal prices have been supported by concerns over rising inflation and geopolitical uncertainty

* However, a rebound in US 10 year bond yields and optimistic sentiments in global markets restricted further upsides in bullion prices

* MCX gold prices are trading in a consolidation range of mean -2 sigma levels (| 50,300) and mean +2 sigma levels of (| 51,400) over the past couple of weeks. Going ahead, the next leg of the move should resume only once gold prices manages to come out of this range. Silver prices are expected to take cues from gold prices and trade in the range of | 61,000 to | 62,000 for the day. Additionally, investors will remain cautious ahead of US Fed Chair Jerome Powell’s testimony.

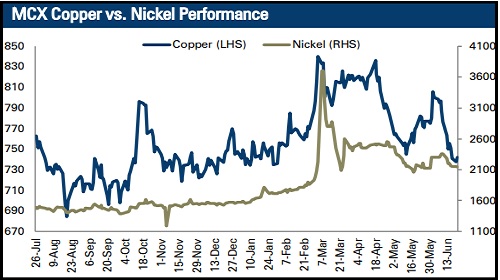

Base Metal Outlook

* LME zinc prices surged around 1.80% on concern over potential shortages resulting from falling inventories and possible reductions in smelter output because of high energy prices

* At the same time, better than expected existing home sales data from the US continued to support the prices on lower side

* Additionally, the premium for cash LME zinc over the three-month contract spiked to $76.25 a tonne, its strongest since December and up from $14.30 a week ago, indicating short-term shortages of LME inventories

* MCX zinc prices are expected to rally towards | 322 levels for the day due to easing dollar index and significant decline in LME inventories.

Energy Outlook

* WTI crude oil prices advanced almost 1.50% on high summer fuel demand while supplies remained tight because of sanctions on Russian oil

* European Union leaders aim to maintain pressure on Russia at their summit this week by committing to further work on sanctions, a draft document showed

* US natural gas futures rose more than 2.50% after Russian Gazprom halted gas supplies to Germany from Monday

* MCX natural gas prices are expected to trade with a positive bias for the day due to tight supply. It is taking support at | 512 levels over the last couple of days. As long as it sustains above this level, it is likely to move further towards | 575 levels in the coming sessions.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer