Weekly Report: Metals & Energy By Religare Broking Ltd

GOLD

The positive momentum eased in gold with prices losing more than 3% in the week. Ahead of the highlyanticipated US labor market, investors will keep a close eye on fresh developments surrounding the Trump administration’s trade policy in the first half of the week. Meanwhile Trump has confirmed 25% tariffs on Mexico and Canada, fueling market uncertainty. The Fed is expected to cut rates by 70 bps in 2025 with first cut projected for June. Gold’s upside rally may halt for a while under existing scenario.

Technical Outlook

The near-term technical outlook highlights a build-up of bearish momentum, thus reducing the upside potential for the coming week. MCX gold has a strong resistance zone between 85800 and 86000. Sell on every rise and the standard stop loss for the shorts will be above the 86000 level.

SILVER

CME silver settled at $31.15, down 4.04%, as a stronger U.S. dollar and falling gold prices maintained the pressure. Broad risk-off sentiment and economic data reinforcing a cautious Federal Reserve stance, kept silver under pressure. US’ announcement of 25% tariffs on Mexican and Canadian goods, and 10% duty on Chinese imports raised concerns over economic growth and industrial demand. The near term view remains bearish .

Technical Outlook

Silver’s near term outlook has turned bearish. Nevertheless the charts are oversold now. Therefore one should look forward to sell after a correction, and watch out for the inability of prices in sustaining above the 96000 mark, before initiating the short positions.

Crude oil

Crude oil witnessed a limited upside on the back of rising Iraq exports and U.S. tariffs. U.S. tariffs on China, Mexico, and Canada is seen as a dampener for oil demand, adding uncertainty to an already fragile crude market outlook. However traders are focusing on a higher possibility of U.S. Strategic Petroleum Reserve purchases as a support for oil prices. We expect crude oil to move in a moderate price range and the overall outlook appears sideways.

Technical Outlook

The short term directional indicators point towards further gains from the current levels. But the broader view suggest lower chances of a sustainable rally. All in the outlook is sideways to positive with an intermediate support near the 5900 level. Buying recommended in crude oil but with small targets and tight stop losses.

Natural gas

U.S. natural gas futures dropped 8.5% last week as mild weather cut heating demand, enhancing concerns about further downside risk. The EIA reported a 261 Bcf storage draw, leaving inventories 11.5% below the fiveyear average. Also, LNG exports remain firm at 15.6 Bcf/day, However, the warmer-than-normal March forecasts shall weaken natural gas demand and reduce the upside potential in the coming weeks.

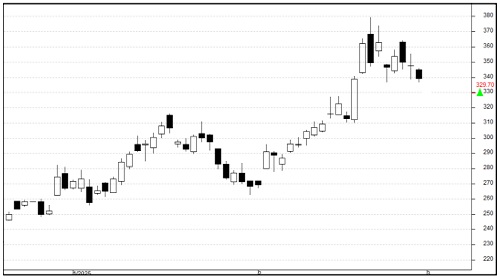

Technical Outlook

Prices at MCX failed to sustain above 350 and closed the week on a subdued note. The positive momentum is easing gradually. For the week we see a strong resistance zone between 350 and 360. Unless there is a decisive breakout from the 360 level, maintain sell on every rise.

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330