India's manufacturing sector finishes 2022 on solid note with PMI of 57.8 in December

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

India's manufacturing sector finished 2022 on a solid note with PMI of 57.8 in December, as business conditions improved to the greatest extent in over two years. Hiring activity was stretched to December, while more inputs were acquired as firms sought to supplement production and add to their inventories. Input cost inflation was contained, but there was a solid and quicker increase in selling prices.

According to the report, the seasonally adjusted S&P Global India Manufacturing Purchasing Managers’ Index (PMI) increased to 57.8 in December from 55.7 in November. It further noted that demand resilience boosted sales growth in December, with the rate of increase picking up to the quickest since February 2021. International demand for Indian goods also improved, but did so to a lesser extent than in November. Overall, new orders from abroad rose at the slowest pace in five months as several companies reportedly struggled to secure new work from key export markets.

The report further said that with overall demand remaining conducive of growth, manufacturers scaled up production at the end of 2022. The upturn in output was sharp and the best seen since November 2021. It also pointed to a further increase in buying levels among goods producers. Moreover, the rate of expansion was historically sharp and the strongest since May 2022.

Besides, the report noted that suppliers to the Indian manufacturing sector were comfortably able to accommodate for the uptick in input demand, with average lead times unchanged from November. Manufacturers themselves faced mild pressures on their operating capacities as signalled by a further, albeit slower, increase in outstanding business. To address backlogged work, Indian goods producers hired additional staff at the end of the year. The latest increase in employment was the tenth in consecutive months but the slowest since September.

Top News

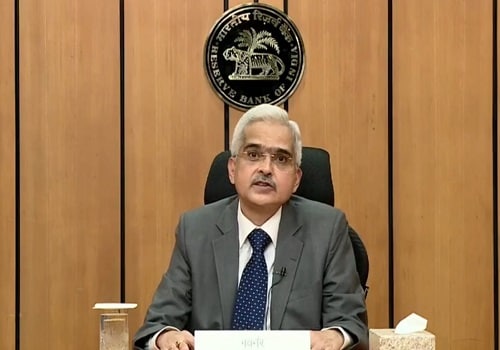

Government committed to bring economy on fiscal consolidation path in near-to-medium term: N...

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings