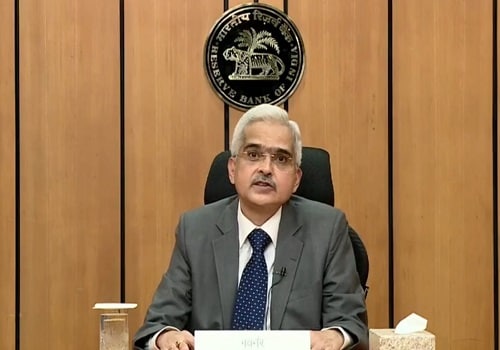

Reserve Bank of India increases repo rate by 35 basis points

The Reserve Bank of India (RBI) has increased the policy repo rate under the liquidity adjustment facility (LAF) by 35 basis points to 6.25 per cent with immediate effect. Consequently, the standing deposit facility (SDF) rate stands adjusted to 6.00 per cent and the marginal standing facility (MSF) rate and the Bank Rate to 6.50 per cent.

RBI’s Monetary Policy Committee (MPC) also decided to remain focused on withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth. These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

On the price front, inflation is projected at 6.7 per cent in 2022-23, with Q3 at 6.6 per cent and Q4 at 5.9 per cent, and risks evenly balanced. CPI inflation for Q1:2023-24 is projected at 5.0 per cent and for Q2 at 5.4 per cent, on the assumption of a normal monsoon. On the economic growth front, the real GDP growth for 2022-23 is projected at 6.8 per cent with Q3 at 4.4 per cent and Q4 at 4.2 per cent, with risks evenly balanced. Real GDP growth is projected at 7.1 per cent for Q1:2023-24 and at 5.9 per cent for Q2.

The RBI also noted that the global economic outlook is skewed to the downside. Global growth is set to lose momentum as monetary policy actions tighten financial conditions and as consumer confidence weakens with the rising cost of livelihood. Inflation remains elevated and persistent across countries as they grapple with food and energy price shocks and shortages. More recently, however, there are some signs of moderation in price pressures, which have raised expectations of an easing in the pace of monetary tightening.