Check Out the Different Types of Mutual Funds to Invest In

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

When you go about creating a diversified financial portfolio, having mutual funds be a part of them is imperative. Mutual funds are investment vehicles that pool different investors’ money into market securities to generate returns. They are professionally managed and are intended to meet certain goals.

Depending on the kind of assets they invest in, mutual funds are categorized into different types. Based on asset classes, these are the different types of mutual funds that are available in the market:

- Equity Funds: Equity mutual funds invest a majority of their fund money in equities or shares or companies. While they are considered risky investments because of the potential stock volatility, they also have the possibility of giving high returns. They can further be classified into:

- Growth funds: These invest in equities that are aimed at generating wealth. They typically do not pau dividends and instead, reinvest profit for growth.

- Income funds: Income mutual funds invest in stocks that pay dividends. They are considered more conservative than growth funds and are ideal for investors seeking a regular income.

- Index funds: These funds invest according to a specific index, such as the Nifty50 or Sensex. The goal is to track the performance of the index invested in.

- Sector funds: Sector mutual funds invest in specific sectors in the market such as agriculture or green companies. The idea is to benefit from the growth of a particular industry

- Debt Funds: Debt mutual funds invest a majority of the fund money in debt securities such as government bonds, treasury bills, company bonds, debentures and other fixed income instruments. They are less risky than equity mutual funds but provide a lower rate of return. Debt funds are good investments for investors with a low risk appetite who want the benefit of mutual funds but don’t want to assume the excess risk of equity mutual funds. The different types of debt mutual funds are:

- Overnight and Liquid Funds:Overnight funds invest in debt securities with a maturity period of a day. Liquid funds put their money in securities with a maturity of up to 90 days. These are ideal for investors

- Money Market Funds: Money market funds are debt funds that invest in money market instruments with a maturity of up to one year.

- Dynamic Bond Funds:These funds invest in debt securities across durations. Fund managers rebalance portfolios according to market conditions.

- Corporate Bond Funds:These debt funds invest at least 80% of their fund money in corporate securities with different credit ratings, mostly high-rated corporate securities.

- Credit Risk Funds:Credit risk funds invest in corporate bonds that have a credit rating below top-rated bonds.

- Gilt Funds: Gilt funds invest a minimum of 80% of their fund money in government securities with different maturity periods.

- Hybrid Funds:Hybrid funds invest in different asset classes. Usually, it is a mix of equities and debt instruments. These funds balance out risk and reward and are ideal for investors who have a medium risk appetite. You can choose to invest in funds between a higher equity or a higher debt allocation, depending on what your financial goals are.

- Exchange-traded funds:Exchange-traded funds or ETFs are funds are traded on exchanges like stocks. They can be traded real-time.

- Fund of funds: These special category of funds invest in other mutual funds to generate returns.

Choosing the Right Mutual Fund

The best mutual fund to invest in,depends upon your risk appetite and your financial goals. For instance, if you have a high risk appetite and want to generate long-term wealth, then equity mutual funds are a good choice. If you have a low risk appetite, then debt funds may be a better choice.

ICICI Direct has a range of mutual funds that you can choose from. It gives you a simple and convenient way to invest in any kind of mutual fund and can also track the performance of different funds so that you can make the right investment choice. In addition, they have essential tools like a mutual fund calculator to help you calculate the past returns which will help you invest wisely.

Above views are of the author and not of the website kindly read disclaimer

Top News

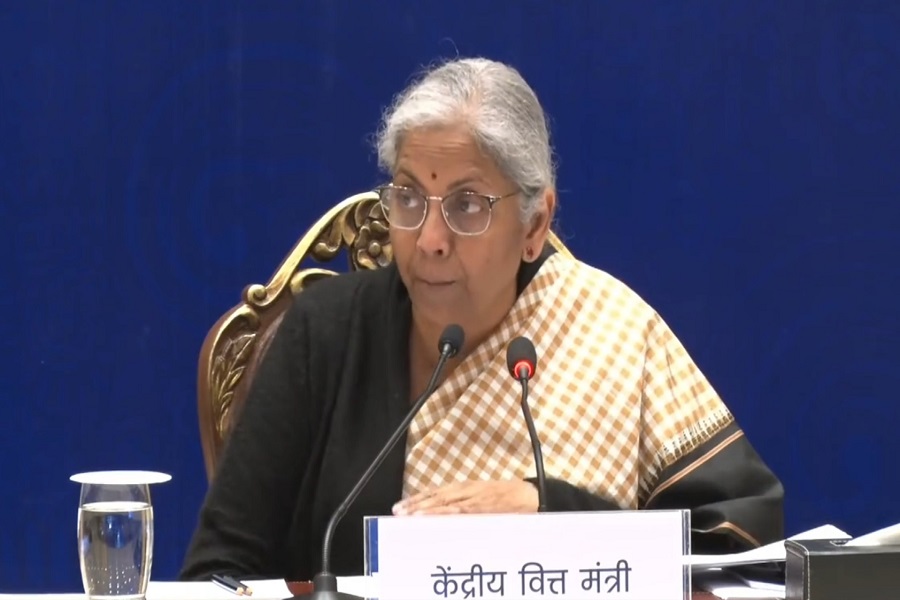

GDP growth in Q1FY24 should be good; government priority is to tame inflation: FM Nirmala Si...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">