Budget 2022 : Approaching an Amrut Kal - Axis Mutual Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Introduction

The honourable finance minister, Nirmala Sitharaman, delivered a pragmatic yet capex heavy budget aimed at addressing key bottlenecks in the Indian economy. Spearheaded by government spending on long term projects, the government has aimed to remove stumbling blocks to economic growth.

The finance minister outlined 4 focal points that Budget 2022 aimed to address

Key Highlights

* Fiscal Deficit for FY 2021-22 pegged at 6.9% (RE), FY 2022-23 at 6.4%. Will return to the recommended level of ~3% by FY26

* Government Capex for FY 23 hiked 30%+ to Rs 7.5 lakh Cr

* No changes to personal income tax limits or tax brackets

* Gross government borrowing for FY 23 pegged at Rs 14.96 lakh crore

* New taxation structure on virtual digital assets

* Long term cap gain tax surcharge capped at 15%

* FY 23 divestment target significantly smaller at Rs 65,000 Cr

Budget Takeaways

Budget 2022 continues to drive the investment push from the top as the government engages all leavers to ensure that the Indian economy remains the fastest growing large economy on the planet. New initiatives on promulgating the startup ecosphere and improving ease of doing business are likely to give markets direction on the government’s thinking of a future ready Indian economy. Notably in its attempt to push growth, the government has significantly opened up the economic wallet leveraging the above estimate revenue collections and a large borrowing program

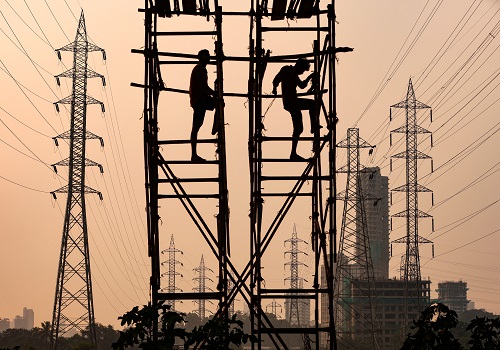

Capex all the way – Focus on Implementation will be key

The PM Gatishakti program to improve connectivity and reduce logistical bottlenecks is likely to drive Capex spending for the year. A significant jump in capex allocation (Rs 7.5 lakh Cr a 30%+ jump from 2021) if implemented well will act as significant conduits from the domestic economy. The series of programs aimed at improving local standard of living like the ‘PM Awaas Yojana’, ‘Jal se Nal’ yojana and programs around education and healthcare could infuse fresh blood in areas of the Indian economy that can be perceived as ‘low hanging fruits’ for development.

For FY22 (BE) – Capex will roughly account for ~3% of GDP. The government has also increasingly used state bodies and the state machinery to ensure better utilization and larger multiplier effect with large infrastructure projects. Synergies will be key to watch out for in the year ahead.

Sustainability & The Need to Promote Sunrise Industries

Recognizing the need to cultivate and develop technologies of the future the government has committed to supporting sustainable technologies through several targeted development programs. A New Production linked incentive scheme (PLI) for the solar industry and introduction of Sovereign Green bonds for Carbon neutral projects has also been proposed

Bond Inclusion Hopes Dashed

The budget speech and documents did not discuss the changes to capital gains tax for India bonds that could have enabled inclusion into bond indices. The likelihood is low for it to be taken up in this Budget session of the Parliament with the Finance Bill already tabled. With a larger than expected supply to absorb, this disappointment has driven bond yields sharply higher.

Crypto, Blockchain & Digital Assets

In an attempt at regulation and as a perceived precursor to the possible Crypto Currency bill, the Budget outlined a series of measures to ensure adequate regulatory cover to navigate the evolving ecosphere. Notable announcements include

- A New Digital Rupee backed by the RBI harnessing the attributes of blockchain to boost the digital economy and offer a more efficient and cheaper currency management system

- Introduction of a specific Taxation regime of Virtual digital assets

- TDS on transfer of digital assets

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer