Clear growth orientation while ushering in digital economy - Ventura Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Clear growth orientation while ushering in digital economy

The architecture of the Union Budget 2022-23 is on continuum of previous policies of the Modi Government, as laid out in the budgets of yesteryears. The Finance Minister, N Sitharaman’s speech was silent on the aspect of sin tax on tobacco products and personal taxation, while taxing crypto & NFT assets at 30% and clearly distinguishing this asset class from being a currency. She also used the forum to propose India’s own digital currency and rationalize the surcharge on LTCG at 15% across all asset classes (from only listed equities and mutual funds earlier). Barring inflation (an uncontrollable variable), all concerns of the market have been addressed. This itself is a very big positive.

The budget has been sensitive to the fallout of the pandemic and other headwinds, like the FED induced global re-set of interest rates, which are looming on the horizon and the supply side induced inflationary animal spirits, in particular the rising price of crude oil. Keeping in mind these uncertain variables, the budget has earmarked

* A higher capex spend of INR 7.5 lakh cr (35.4% over FY22BE/ 24.5% over FY22RE) to sustain the green shoots of growth, which have sprouted in FY21.

* Realistically, it kept revenue estimates conservative at INR 22.0 lakh cr, which is far lower than the 8 months run-rate of INR 13.6 lakh cr.

* The fiscal deficit has been projected to remain elevated, while still maintaining a glide path of gradual lowering.

* Continuing with infrastructure creation via the PM Gati-Shakti mission and National Master Plan, significant allocation has been made for the infrastructure sector. Special emphasis has been on long term asset creation.

* Customs duty rates have been tinkered with, keeping the best interests of the manufacturing sector in focus.

o Where there is sufficient domestic capacity, rates have been increased, viz certain agricultural produce, chemicals, fabrics, medical devices and drugs and medicines.

o To give impetus to the high growth electronic manufacturing sector, a graded rate structure has been incorporated for wearable/ hearable devices and electronic smart meters.

o Custom duty cuts have been initiated for the gems & jewellery sector, methanol, acetic acid, heavy feed stocks for refineries and parts of transformer of mobile phone chargers and camera lens of mobile camera.

* Financial assistance to States for capital formation has been enhanced to INR 15,000 cr for FY22 and an additional INR 1.0 lakh cr at zero interest for 50 years has been proposed, to catalyze investments by States.

* Sovereign Green Bonds to be issued for green infrastructure, which is in the direction of India’s stated intent at the COP26.

* For the MSME sector, the ECLGS guarantee cover has been expanded by INR 50,000 cr to INR 5.0 lakh cr and the tenure extended to Mar 2023 (the additional cover is purely for hospitality and related sectors). This should go a long way in boosting the confidence of the banking sector towards MSME lending. The CGTMSE has been expanded by INR 2.0 lakh cr and the RAMP program has been incorporated with an outlay of INR 6,000 cr spread over 5 years.

* The domestic solar module manufacturing sector has been given a shot in the arm with an INR 19,500 cr PLI scheme. This will help in augmenting our green energy production to the ambitious 280 GW by FY2030.

* Although NREGA allocation for FY23BE at INR 73,000 cr is lower than the FY22RE INR 98,000 cr, it is maintained at last years’ budgeted estimates. Along with NREGA, the PLI schemes to the 14 sectors has the potential to create 60 lakh new jobs over the next five years. Gati-Shakti is another lever for job creation whose scope is vast and countrywide.

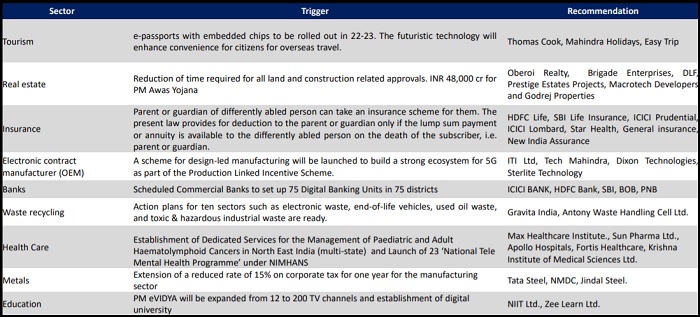

Stocks benefitting from the budget proposal

To Read Complete Report & Disclaimer Click Here

SMS subject to Disclosures and Disclaimer goo.gl/8bCMyQ

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">