‘GATI SHAKTI’ to boost the economy in FY23 - Axis Securities

‘GATI SHAKTI’ to boost the economy in FY23

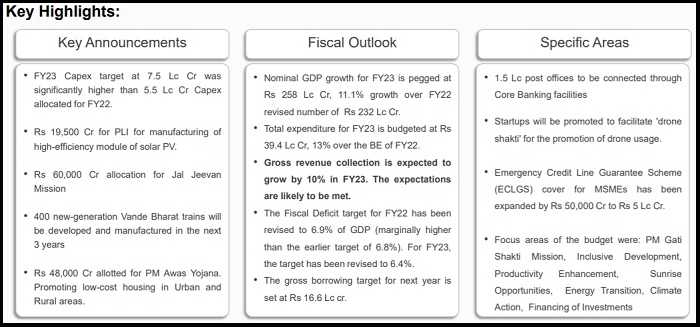

The Union Budget 2022-23 was presented today by the finance minister Nirmala Sitharaman. The expectations from the Budget were reasonably high as the Union Budget 2021-22 had focused on reviving economic growth and not just managing fiscal deficit. In this context, the FY23 Union Budget indeed lived up to the expectations of a growth-focused budget that rightly emphasized the quality of expenditure while achieving robust economic growth. While the budget continued to address the supply-side constraints, the focus on demand-side challenges was lower than expected. Nonetheless, it is important to note that the budget expenditure is on elevated levels vis-à-vis government spending in FY21 and FY22, which should help in delivering broad-based growth moving forward.

The Union Budget’s broad contours include the budgeted expenditure for FY23 estimated at 39.4 Lc Cr with the central government collections (after state transfer) standing at 22.8 Lc Cr. The market borrowing will be 11.5 Lc Cr. Though an increase in the overall expenditure appears to be just 5% over the FY22 expenditure of 37.7 Lc Cr, it is noteworthy that the FY22 numbers have been restated by 8% over the budgeted expenditure. And while the Fiscal Deficit for FY23 has been pegged at 6.4%, for FY22, the government aims to manage it at 6.9% which includes a high likelihood of LIC IPO by Mar’22. To be sure, the FY23 Fiscal Deficit appears optically high as certain off-budget expenditure items of FY22 have been brought under the fold of budgetary expenditure in the overall reporting this year. Keeping this in view, the FY23 Fiscal Deficit target is quite likely to be met. However, the borrowing in FY23 appears slightly elevated which may put pressure on the yields.

A few of the key sector takeaways are as follows:

* Capex spending – the key highlight of the budget: The FY23 Union Budget focused on the Gati Shakti Mission through which the government plans to provide significant thrust to the infrastructure development. This includes impetus to the Roads, Railways, Airways, Ports, Mass Transports, Waterways, and Logistics Infra development. The government increased the headline budgeted Capex by 35% but adjusting for certain expenses, the expenditure growth will be in the healthy double digits. The key sectors expected to benefit from Capex are Cement, Infrastructure companies, Metals, and Capital Goods. The Cement sector should see improving traction as budgetary support will come from infrastructure spending as well as housing spending.

* Neutral for Consumption and Autos: While the emphasis on Electric Vehicles continued, no significant announcements were made for the Auto sector. The PLI schemes continue and we expect more announcements in this space at regular intervals as this continues to be the government’s one of key focus areas. However, no major increase in rural allocation or tax rebates was a dampener for the consumption sector. Nonetheless, the focus on job creation and improving infrastructure will support the growth prospects and fuel future growth in overall consumption.

* Vaccination program and Ayushman Bharat positive: The government has further increased budgetary allocation to the vaccination program which will help companies such as Serum Institute, Dr. Reddy’s, Gland Pharma, and others. Moreover, there is increased support for the Ayushman Bharat program which will help Healthcare companies, moving forward.

* Marginally positive for banks although yields will rise: The support for MSME and SME has been extended into FY23 with an increased allocation of Rs 50,000 Cr to the Hospitality sector. Additionally, affordable housing lending is expected to rise. The increase in Capex spending will also support banks in improving credit growth. While these are positive attributes, primarily due to an excellent nominal growth rate in FY23, the cost of funds of the banks is likely to increase. The bonds, on the other hand, will rise and remain in the ~7% zone for FY23. This is manageable for banks and might even be helpful as the margins can expand.

In conclusion, barring these initiatives, the Union Budget 2022-23 was largely neutral for most other sectors. Based on the above themes the budget picks are as follows:

Our Positive Budget Plays: Federal Bank, City Union Bank, CanFin homes, Polycab, Ambuja Cement, KNR Construction, HG Infra, Asian Paints and ABFRL, Hindalco

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer