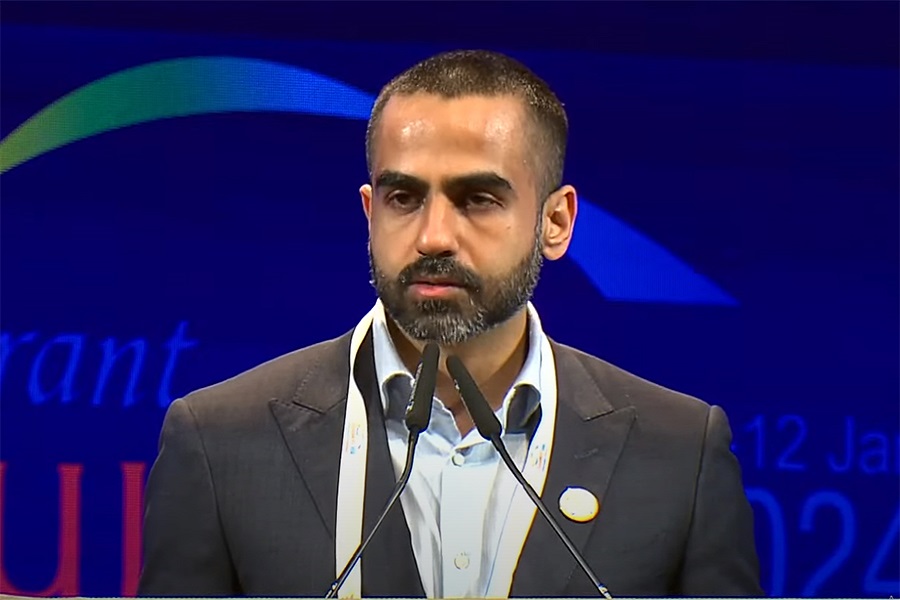

Commodity Article : Gold settles notably higher, Crude under pressure Says Prathamesh Mallya, Angel One

Below is Daily Commodity Article by Mr. Prathamesh Mallya, AVP- Research, Non-Agri Commodities, and Currencies, Angel One Ltd

Gold settles notably higher, Crude under pressure.

GOLD

The upside in the yellow metal was extended further, as the bullion concluded the week on a higher note, being the only commodity to end with gains in the previous week.

Due to recent positive economic indications, investors are still uncertain whether the Fed would resume significant rate hikes.

Fed chair Jerome Powell said during his semi-annual testimony that the US central bank will be prepared to re-accelerate the pace of rate hikes if the economy expands at a quick pace.

Also, bullion is projected to be under pressure as a result of this week's increase in the dollar index and forecasts of additional rate hikes.

Despite the fact that gold is often used as an inflation hedge, zero-yield metal demand tends to fall as interest rates rise.

Outlook: As the US Fed is expected to raise interest rates, gold prices are likely to remain under pressure.

CRUDE OIL

Post handsome gains seen during the previous week, the benchmark crude index NYMEX ended exactly on the opposite side, losing out all of the gains from the week earlier.

Jerome Powell, the chair of the Federal Reserve, said in his testimony that the central bank would probably need to raise interest rates more than anticipated in reaction to recent strong data increasing concerns about weakening demand, which put pressure on oil prices.

Following Powell's remarks, the US dollar, which typically moves in the opposite way of oil, increased to a three-month high against a basket of currencies.

Concerns that interest rate increases would impede economic growth and, as a result, lower demand for oil. Following the Federal Chair's statements, crude prices fell 3%, marking the worst daily decline since early January.

Outlook: According to the US Fed's testimony, higher interest rates would stifle economic expansion and, as a result, reduce demand for oil.

BASE METALS

The base metals pack came under pressure, as all the metals ended on a lower note, with Lead continuing to move lower week on week.

Increasing consumer demand mood among major consumers China, which pushed metals prices higher the previous week, was countered by the US Federal Reserve Chair's hawkish remarks, as the central bank is expected to raise interest rates more than initially anticipated to control inflation.

A three-month high for the dollar against a basket of currencies, as a result of the comments, making it less tempting for holders of other currencies to purchase the commodity priced in dollars.

Jerome Powell's remarks have increased the likelihood that higher rates will last for a longer period of time, therefore investors were getting ready for that eventuality as the dollar marginally dropped from three-month highs.

Outlook: Demand for the metals would be limited by the strong dollar index, which is at 3-month highs due to expectations of a Fed rate hike.

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

More News

OPEC Oil Output Rises in February as Iran, Nigeria Boost Supply by Amit Gupta, Kedia Advisory