Weekly Derivative Report By Axis Securities Ltd

NIFTY HIGHLIGHTS

* Nifty futures closed at 22444.25, with a 2.8% drop in open interest and a 0.9% decline (205.7 points), indicating long unwinding.

* India Vix has decreased to 13.28% from 13.47%, down by 1.4%.

* Bank Nifty futures closed at 48060.4, showing a 6.1% increase in open interest and a 1.1% price drop (520 points), suggesting a short build-up.

* Total outstanding OI in Nifty futures is 2,01,92,475, up from 2,01,33,900 last week, while Bank Nifty is at 45,41,610, compared to 39,30,030.

The Long-Short Ratio for FIIs in index futures remained stable at 0.23; long and short positions have been added, but short outpacing longs suggests caution.

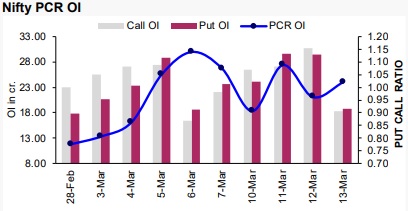

* During the week, the PCR OI reached a high of 1.09 and a low of 0.91, closing at 1.02, up from last week's 1.08.

* The current Put-Call Ratio (PCR) is 1.02, just above the neutral level of 1. This suggests that put option holders outnumber call option holders, reflecting a cautiously optimistic outlook for Nifty in the week ahead.

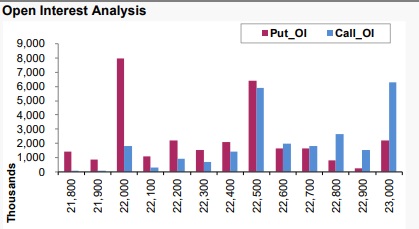

* As per the current expiry, Options built up show that Nifty has strong support at 22,000 and 22,200 and resistance at 22,700 and 23,000.

* The monthly options data reveals significant open interest in Call options at the 23,000 and 22,500 strike prices. In contrast, put options display the most open interest at the 22,000 strike, followed by the 21,500 level. Nifty's projected weekly range is expected to be between 22,200 and 23,000, with 22,500 acting as the crucial level.

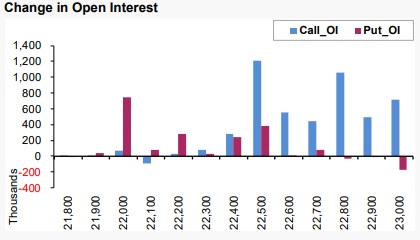

* This week's major monthly expiry addition was seen on the Call front in 22,500, 22,800, and 23,000 strikes, adding 12.1 Lc, 10.6 Lc, and 7.1 Lc shares in OI, respectively, while there was no significant unwinding seen at any strike.

* This week's significant monthly expiry addition was seen on the Put front in the 22,000, 22,200, and 22,500 strikes, adding 7.5 Lc, 2.8 Lc, and 3.8 Lc shares in OI, respectively, while there was unwinding witnessed at 23,000 strike.

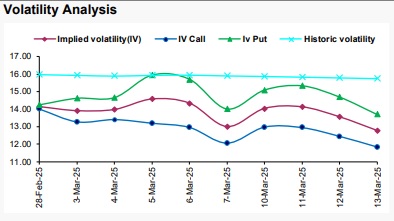

* The implied volatility gap between Calls and Puts has narrowed, suggesting that Nifty is expected to move within a similar or tighter range compared to the previous week, with a cautious sentiment.

* Call IV’s is currently at 11.83% versus 12.95% compared to last week, while Put IV’s is at 13.7% versus 15.7% compared to last week.

* The current option series shows a 12.8% implied volatility (IV), down from 13% last week. These IV drops indicate lower market-perceived price volatility. Expect reduced option premiums for both calls and puts, reflecting a smaller chance of significant price swings.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633