Weekly Commodity Insights 22th September 2025 by Axis Securities

The Week That Was

* Gold climbed to $3,680 per ounce on Friday, marking its fifth consecutive weekly gain as the Federal Reserve’s first rate cut of the year boosted demand for non-yielding assets. Lower interest rates have reduced the opportunity cost of holding gold, while investors continue to monitor signals on future policy direction. Markets are anticipating further easing this year, reinforcing the metal’s bullish momentum. Persistent economic uncertainty and strong central bank demand have continued to support safe-haven flows, keeping prices near record levels. Technical momentum and steady ETF inflows have also contributed to gold’s upward trend.

* Silver advanced over 1% to above $42.2 per ounce, recovering earlier losses in the week as traders reassessed the outlook for U.S. monetary policy. The Fed’s quarter-point cut and projections for two more reductions in 2025 lifted market sentiment, though Powell emphasised the move was a risk management step rather than the start of aggressive easing. A softer dollar added strength to precious metals, while industrial demand prospects also helped silver’s rebound. However, guidance of only one rate cut in 2026 tempered optimism, leaving investors cautious about volatility in Fed communication and future policy shifts.

* WTI crude futures fell 1.4% to $62.7 per barrel, extending losses for the third session in a row as oversupply concerns and weakening demand outlooks outweighed support from geopolitical risks. Ample global production, ongoing refinery maintenance, and rising U.S. distillate inventories continued to pressure prices, while a stronger dollar further dampened oil demand. Although repeated Ukrainian strikes on Russian energy infrastructure and discussions of international levies offered some upside risk, traders remained focused on oversupply dynamics. Developments in U.S.-China-India relations, which could influence Russian crude flows, were also closely watched, but sentiment remained bearish in the near term.

* U.S. natural gas futures extended their decline for a third straight session, weighed by persistently high inventories and mild temperature forecasts that limited demand expectations. This week’s storage build exceeded consensus, adding further pressure to already oversupplied markets. Traders noted little near-term support for prices as consumption signals remained weak heading into autumn. However, the EU’s decision to ban Russian LNG imports from 2026—a year earlier than previously planned—may boost U.S. export demand in the longer term. Despite this potential tailwind, short-term fundamentals kept prices under pressure.

MCX Gold

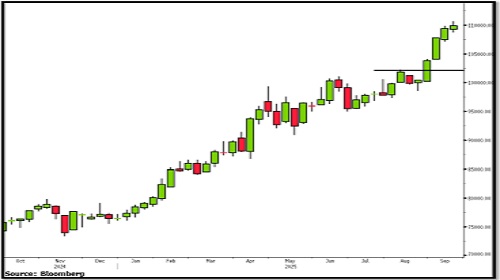

Technical Outlook:

MCX Gold settled higher, marking its fourth consecutive weekly gain and extending the prevailing uptrend pattern of higher highs and higher lows on the weekly chart. The broader momentum remains strong; however, the daily RSI has eased from overbought territory, indicating signs of indecision in the near term. Key resistance is placed at Rs 1,11,000, and a decisive breakout above this level could trigger the next leg of the rally towards Rs 1,14,000 and Rs 1,16,000. On the downside, strong support is seen at Rs 1,08,000, which is expected to act as a cushion in the coming weeks

Recommendation: We recommend buying MCX Gold above Rs 1,11,000, with a stoploss below Rs 1,08,500 and targets of Rs 1,14,000 and Rs 1,16,000.

Current market price (CMP): Rs 1,09,850.

MCX Silver

Technical Outlook:

MCX Silver closed with strong weekly gains of over 2%, supported by firm underlying momentum. However, the daily RSI is forming lower highs and lower lows, signalling a negative divergence that warrants caution in the near term. Immediate resistance is placed at Rs 1,31,000, and a sustained breakout above this level could open the upside towards Rs 1,35,000 and Rs 1,38,000. On the downside, strong support is established at Rs 1,25,000, which is likely to act as a key base for the coming sessions.

Recommendation: We recommend buying MCX Silver above Rs 1,31,000, with a stop-loss below Rs 1,28,000 and targets of Rs 1,35,000 and Rs 1,38,000.

Current market price (CMP): Rs 1,29,840.

MCX Crude Oil

Technical Outlook:

MCX Crude Oil settled with a weekly loss of 0.45%, with prices continuing to trade within a restricted range of Rs 5,850–Rs 5,400. The weekly RSI is forming lower highs and lower lows, indicating weakness in the trend and a bearish undertone. A decisive breakdown below Rs 5,400 could trigger a sharp decline towards the Rs 5,100 and Rs 5,000 levels. On the upside, strong resistance is placed at Rs 5,700, which is expected to cap gains in the near term.

Recommendation: We recommend selling MCX Crude Oil below Rs 5,400, with a stop-loss above Rs 5,600 and targets of Rs 5,100 and Rs 5,000.

Current market price (CMP): Rs 5,550.

MCX Copper

Technical Outlook:

MCX Copper failed to sustain gains last week and ended lower by nearly 0.8%, after once again facing resistance at Rs 923. The inability to break above this level highlights a short-term consolidation phase. However, the weekly RSI is holding around 60, indicating underlying strength in the broader trend. A breakout above Rs 923 could trigger a strong upside move towards the Rs 950 and Rs 970 levels. On the downside, immediate support is placed at Rs 880, which is expected to cushion prices in the near term.

Recommendation : We recommend buying MCX Copper above Rs 923, with a stoploss below Rs 905 and targets of Rs 950 and Rs 970.

Current market price (CMP): Rs 907.

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633