Views on Gold and Silver November 2025 by Mr. Manav Modi, Analyst – Commodity & Currency,Motilal Oswal Financial Services Ltd

Precious Metals

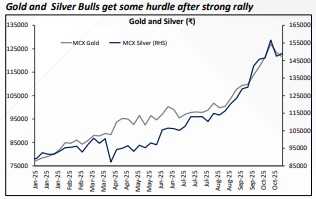

* Bullion flexed green for months, but October stirred bears— an interesting ‘plot twist’ in bullion market

* The month started with bullish momentum for Gold and Silver posting all time high of ~$4380 and ~$54 respectively

* Profit booking turned into panic selling, US-China trade talks, cautious Fed tone and overall market equilibrium, set the tone for bears

* Dollar index after month of consolidation started its journey slowly higher, inching towards 100

* USDINR also followed suit and tried to break 89 once again

* Despite the fall, Silver continued to outperform as copper surged amidst mine closures leading to supply tightness

* Fed cut rates to 3.75–4.00% and announced end of QT from December 1

* Fed injected liquidity of ~$29.4B, suggesting short-term funding stress

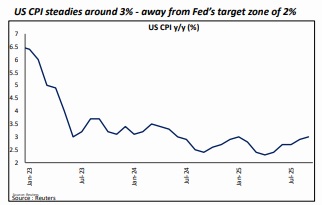

* Governor Powell flagged concerns over inflation and growth, signalling low odds of a December rate cut

* After his comments, probability for Dec’25 rate cut dropped from 90% to 70%

* Prolonged US government shutdown is now past 30 days, nearing the 34-day record from 2018-19, lifting safe-haven demand

* Data blackout risk from shutdown raised volatility fears

* Despite shutdown, US CPI was reported lower than estimates, making no major impact on prices

Precious Metals

* Trade framework discussions between US and China helped calm tariff fears

* China expected to delay rare-earth licensing and resume U.S. soybean purchases

* Comments from China is still pending however, US signalled positive updates from the meet

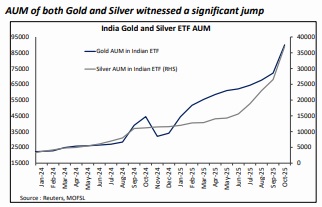

* Geo-political tensions continue to support prices • China planned to secure foreign sovereign gold reserves and also removed VAT relief on gold bought from SGE

* Many banks in China have closed retail gold accounts to new investors as China removed VAT exemptions on gold purchases, but also cut the full 13% VAT exemption to 6%

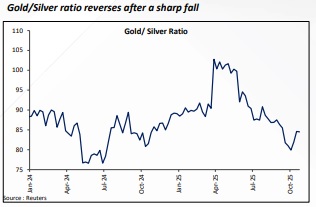

* Gold/Silver Ratio reversed after posting recent lows of 78

* Demand and Supply dislocation was in limelight last month

* Towards the festive season amidst the acute supply tightness, silver premiums in ETF and physical surged through the roof

* Premiums were more than 8-10% increasing panic pushing prices higher and a rare backwardation in silver market

* Focus now will be on comments and plan of action between US and China

* Comment from fed officials and update on US shutdown will also be important to watch

* Prices could trade in a broad range for this month

Gold

Silver

Base Metals- Copper

* Copper prices rallied above Rs.1000 and on LME above $11,000 supported by renewed confidence in trade negotiations and tightening supply dynamics

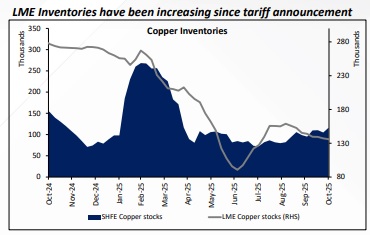

* LME inventories have inched ~50% lower and SHFE is 43% lower, since the beginning of the year

* ICSG indicated that global refined copper market posted an apparent surplus of 147,000 tons in the first eight months of 2025, down sharply from 477,000 tons a year earlier

* 2026 forecasts still show deficit figures of 150,000 metric tons from the previously expected surplus of 209,000 tons due to slower production growth

* World apparent refined copper usage rose 6% over the first eight months of 2025, while production grew by 4% in the same period

* Glencore cut its 2025 output forecast to 850–875kt (from 890kt)

* Collahuasi mine issues in Chile offset strong output from Africa and Peru

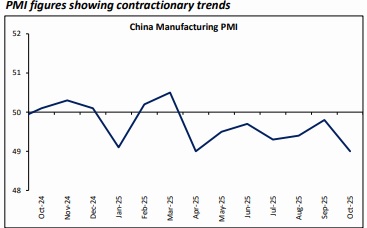

* While supply disruptions remain, some signs of weak domestic demand including diminishing Yangshan copper premium and contractionary PMI figures created some hiccups

* Broader outlook remains bullish, with renewable energy and electrification keeping global demand strong

* Copper prices are expected to trade in a higher range supported by constrained supply and firm demand for copper, while some dips may be seen as buying opportunity.

Base Metals- Zinc

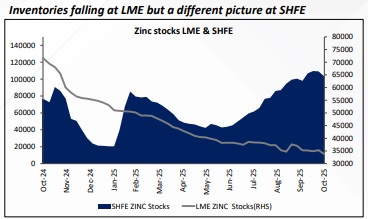

* MCX zinc prices rose 4.5%, supported by depleting LME inventories and growing investor sentiment

* LME zinc stocks halved dropped to their lowest to a two year low of 38000 tonnes

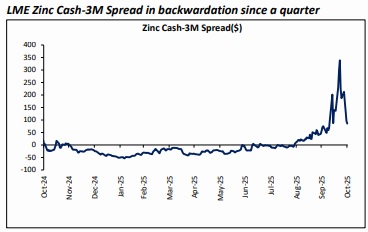

* LME Zinc Cash-3M flared out to $350 per mt this month, tightest since 1980, and continues to stay in backwardation, showing tight near term supply

* Production outside of China has been falling with Toho Zinc's Annaka smelter in Japan and Glencore’s secondary zinc operations in Italy, shut down completely

* A planned shutdown of Nyrstar’s Clarksville smelter in the US this October–November is expected to tighten supply further

* Some zinc mines in northern China are expected to reduce or halt production starting in November

* ILZSG estimated a global surplus of 85000 tonnes this year, tighter than the 185,000 MT surplus a year earlier

* A 6.3% increase in mined zinc output this year is reported, but refined production fell by over 2% due to bottlenecks at refineries, particularly in Kazakhstan and China

* Zinc prices are expected to trade higher supported by low inventories and tightening supply woes, while some pressure from rising DXY may cap gains

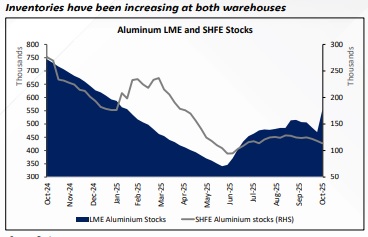

Base Metals- Aluminium

* MCX Aluminum prices rose 5% on easing US-China tensions and uptick in sentiment around metals

* On the inventories front, LME Inventories are 14% lower YTD

* IAI showed global aluminium demand will increase by almost 40% by 2030

* Aluminium sector will need to produce an additional 33.3 Mt to meet demand growth in all industrial sectors – from 86.2 Mt in 2020 to119.5 Mt in 2030

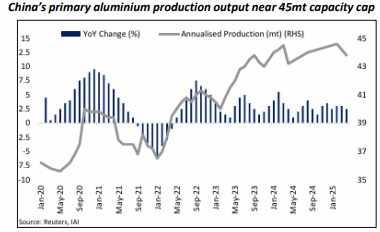

* On the supply side, China reaffirmed its commitment to preventing overcapacity in metal production

* China’s annual aluminum output cap of 45 million tons is expected to be breached later this year

* Operational disruptions at key refineries further constrained supply

* Troubles for key refineries also pressured supply, with one of two potlines in Iceland's Grundartangi smelter being suspended due to electrical equipment failure

* Alcoa announced the closure of its Kwinana alumina refinery in Australia amid declining bauxite ore quality

* Aluminium prices remain supported by uptick in sentiment and few green shoots of demand

Copper

Zinc

Aluminium

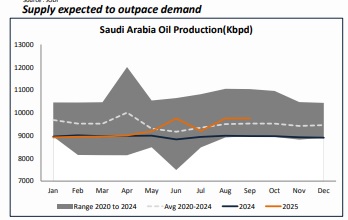

Crude Oil

* Oil prices fell 3% last month despite geopolitical tensions and inventory drawdowns, as demand weakness remained the main concern.

* Russian sanctions news briefly lifted prices, but markets expect Russian crude to find alternative buyers, keeping global supply well-supported.

* Economic data remains weak, and the ongoing U.S. government shutdown adds to concerns over growth and fuel demand.

* EIA inventory data supported oil prices for whole month, with Stronger domestic demand and implied gasoline demand increasing 470k b/d WoW, while refiners also reduced their utilisation rates by 2% to 86.6%

* Oil got support by concerns over supply disruptions, after Ukraine struck one of Russia’s main Black Sea oil ports. The attack is part of strategy to hinder Russia’s war efforts by attacking energy infrastructure.

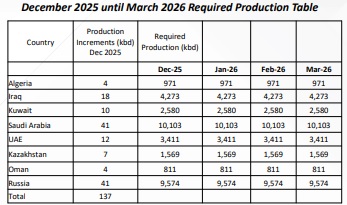

* OPEC+’s limited December output hike and pause in Q1 2026 signal caution, providing a floor to prices amid demand uncertainty.

* Non-OPEC output, led by U.S. shale, stays strong, capping upside potential for crude.

* Geopolitical risk persists as Trump’s military threats in Nigeria and Venezuela heighten supply disruption fears.

* The U.S. begins modest SPR refills (1 million barrels for Dec–Jan delivery), appearing more political than strategic, with delayed deliveries and limited impact on market balances.

* Prices are expected to stay positive, as OPEC decision is bit of insurance against current market uncertainties on both the supply and demand fronts

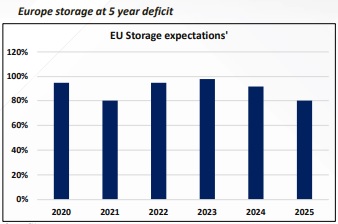

Natural Gas

* Natural gas prices began the winter season at a lower point, trading 16% below their April highs due to persistent high injection rates and robust production.

* A colder winter scenario is anticipated to increase natural gas consumption by 5% and expenditures by 3% compared to last winter, driving an uptick in heating demand as temperatures fall.

* U.S. natural gas deal activity has significantly surged in 2025, with analysts forecasting further acceleration. This is primarily fuelled by record power demand from AI data centers, increasing LNG exports, and renewed Asian investment.

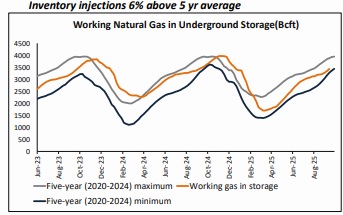

* Working gas inventories remain comfortably above the five-year average, providing a strong cushion against supply shocks this winter

* U.S. natural gas production continues to hover near record highs around 105–107 Bcf/d, keeping the market well-supplied

* Mild early-winter weather and high output are expected to lead to additional storage builds, reinforcing supply security

* Any production slowdown amid colder-than-expected conditions could tighten balances quickly and lift prices

* Rising LNG exports and growing feed gas demand continue to absorb part of the domestic surplus.

* Power sector demand is rising due to data center and AI-driven electricity consumption, adding to structural load growth.

* Pipeline capacity constraints leave the system vulnerable to maintenance outages or regional bottlenecks.

* Market volatility remains a key feature — sharp cold snaps, LNG export surges, or infrastructure disruptions could spark price spikes.

* Overall, prices are likely to remain stay higher most of the season, with upside risk concentrated in eventdriven supply disruptions or unexpected cold weather.

Crude Oil

Natural Gas

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412