US CPI Inflation : Fed to prioritise labour market weakness over inflation by JM Financial Services Ltd

Headline inflation firmed up in August to 2.9% (2.7% prior) with a stronger-than-expected momentum of 0.4% MoM. Commodities fueled headline inflation while services moderated. Unlike headline, core inflation was stable on a sequential basis. The inflationary pressures in consumer-facing categories like food, apparels and energy were notable. However, the impact of tariffs on inflation print is yet to reflect meaningfully, likely due to limited passthrough. The labour market reflects deterioration across various parameters – non-farm payrolls, unemployment claims and unemployment rate. We believe that the Fed will prioritise addressing these weaknesses over the firm inflation print in the upcoming FOMC meet. Taking cues from the sluggish labour market and the PPI reading, bond yields have already softened ~ 25bps, building in rate cut expectations. We expect two more rate cuts by the end of 2025, starting with a 25bps rate cut in September.

* Inflation firms up in August: CPI inflation gained momentum in August. However, the reading was on expected lines. Headline inflation inched up to 2.9% (2.7% prior) with a sequential uptick of 0.4% MoM, marginally stronger than market expectations of 0.3% MoM. On a broader level, inflationary pressure gained pace in commodities while it eased in services. With calls for policy easing from the US administration getting louder with every passing day, we expect the Fed to prioritise addressing the sluggishness in the labour market vs. firm inflationary pressures. We are building in two rate cuts by the end of 2025, starting with a 25bps rate cut in September.

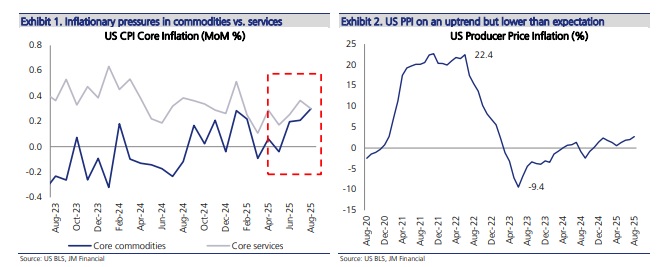

* Inflationary pressures in commodities vs. in services: On a broader level, it was commodities (0.3% MoM vs. 0.21% MoM prior) that fueled inflationary pressures while the moderation in services (0.3% MoM vs. 0.4% MoM prior) aided the headline inflation. Every CPI print post Apr’25 is being closely analysed by the market for signs of a tariffinduced uptick; however, a meaningful impact is yet to reflect in the CPI print. We observed an uptick in consumer-facing categories like apparels (0.5% MoM vs. 0.1 MoM prior) and food (0.5% MoM vs. 0.1 MoM prior). The uptick in energy inflation was noteworthy at 0.7% MoM, which reverted from deflationary pressures in the previous month (-1.1% MOM). Sharp sequential gains in airfares (5.9% MoM vs. 4.04% MoM prior) and public transport (3.6% MoM vs. 2.97% MoM prior) was cushioned by deflationary pressures in car rentals (-6.9% MoM vs. -2.9% Prior). Unlike CPI inflation, producer price inflation (PPI) was cooler than expected in August, moderating to 2.6% (- 0.1% MoM) vs. expectations of 3.3% (0.3% MoM).

* Fed to deliver rate cut in September: The Fed Chairman had indicated in the FOMC meeting in Jul’25 that the policy action going forward would depend on the state of the labour market. The deterioration in the labour market is evident in sluggish non-farm payrolls, unemployment claims and unemployment rate. Non-farm payroll reading of 22K jobs in September was significantly lower than market expectations of 75K jobs; moreover, the unemployment rate inched up to 4.3% - higher than the 6-month moving average – indicating a sustained uptick in unemployment (Ex 3 & 4). Benchmark yields had already softened post lower-than-anticipated producer price inflation; however, the absence of any surprise in the CPI print in August further eased pressure off the yields to 4%. The futures market is building in three rate cuts by the end of 2025, starting with a 25bps rate cut in September. We believe that it would be realistic to expect two more rat0e cuts by the end of 2025, which would also allow the RBI to ease further. An accelerated rate cut cycle in the US would exert pressure on the US dollar and cushion EM currencies including INR.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361

.jpg)

More News

Consumer Goods Sector : Conditions ripe for a demand boost By Prabhudas Liladhar Capital Ltd