Ugro Capital announces financial results for the quarter and nine-month period ended 31st December 2024

UGRO Capital, a leading DataTech NBFC focused on MSME lending, today announced its robust financial performance for the for the Quarter and Nine-month Period ended 31st December 2024. The company recorded its highest ever quarterly loan origination of INR 2,098 crore, surpassing INR 1,552 crore in the same quarter last year. Its Emerging Markets Secured Loans (erstwhile Micro Enterprises business) experienced significant growth, with disbursements at INR 543 Cr in Q3’FY25, up from INR 180 crore in Q3’FY24, underscoring UGRO Capital’s commitment to empowering small businesses.

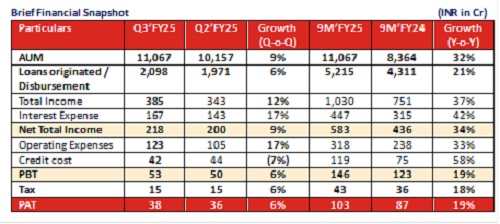

UGRO Capital sustained its growth momentum in Q3’FY25, achieving an AUM of INR 11,067 crore as of Q3’FY25 representing 32% increase compared to Q2’FY24. This surge can be attributed to increasing net loan origination, opening of 74 new branches in Emerging Market Segment in 9MFY25, achieving highest-ever disbursement, Embedded Finance growth and a data-driven underwriting model that together enable consistent quarterly disbursals of over INR 1,000 Cr.

In terms of financial performance, UGRO Capital reported a total income of INR 1,030 crore for the nine-month period (9M’FY25), reflecting a 37% YoY growth. For Q3’FY25, total income stood at INR 385 crore, marking a growth of 38% YoY and 12% QoQ. The PAT for 9M’FY25 scaled up to INR 103 crore, up 19% YoY, while Q3’FY25 PAT was INR 37 crore, reflecting an impressive 15% YoY and 6% QoQ increase. The company achieved net disbursements of INR 5,215 crore in 9M’FY25, reflecting 21% growth, with Q3’FY25 net disbursements reaching INR 2,098 crore, up 6% QoQ.

On the liability side, UGRO Capital mobilized its highest-ever debt of INR 1,400+ crore during Q3’FY25, bringing its total debt to INR 6,151 crore as of December 2024. The robust quarterly performance, coupled with optimal GNPA/NNPA metrics of 2.1%/1.5%, highlights the quality of UGRO's portfolio and reflects a well-structured risk management framework. UGRO Capital's distinctive co-lending approach, accounts for 44% of its off-book AUM, and its strategic partnership with 16 Co-lending partners, 59 lenders, over 60 fintechs, and 730+ GRO partners, facilitates data-driven, tailored financial solutions for more than 1.6 Lakh MSMEs across India.

Speaking on the performance, Mr. Shachindra Nath, Founder and Managing Director of UGRO Capital, said, “Our strong growth trajectory demonstrates the resilience of our business model and our unwavering focus on serving the MSME sector. The GRO Score patent exemplifies our commitment to innovation, and our growing branch network ensures deeper penetration into underserved markets. We aim to scale our micro-enterprise portfolio to ~35% of AUM by March 2026, driving yield expansion and fostering financial inclusion. As we move forward, we are confident in achieving our strategic goals while continuing to empower MSMEs across the country.”

Above views are of the author and not of the website kindly read disclaimer