Turmeric Technical Report As On 24th June 2025 by Kedia Advisory

Turmeric

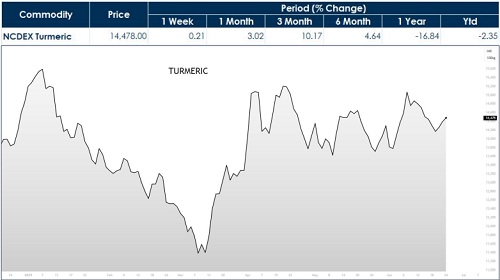

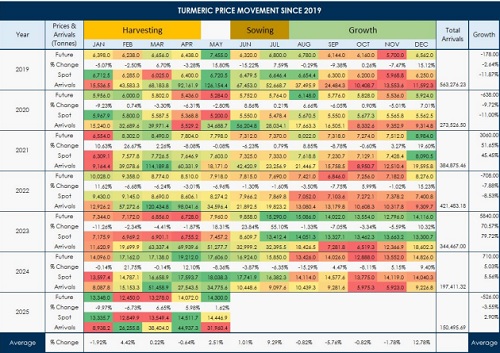

Turmeric futures on NCDEX have entered Elliott Wave 5, supported by a powerful blend of technical confirmation and fundamental strength. Poor turmeric stock levels continue to tighten supply and support upward price movement. Wave 4 bottomed at Rs 13,286, with Wave 5 potentially extending toward Rs 23,530 (1.618 Fibonacci extension of Wave 3). A key signal is the MACD, which is about to make a bullish crossover above the zero line—a high-conviction signal. In May 2023, a similar MACD crossover led to a rally from Rs 6,512 to Rs 20,430 within months, validating the indicator's effectiveness in this commodity. The RSI at 54.49 remains above the midline, confirming momentum. The Choppiness Index (CHOP) at 46.96 suggests that volatility is compressing and the market is gearing up for a directional move. Volume remains strong at 61.24K, adding institutional weight to the rally.

Buying Strategy: Current price is Rs 14,388. As long as prices stay above Rs 12,500, the trend remains strong. HOLD long positions and look to add between Rs 13,500–Rs 13,800, keeping a stop-loss at Rs 12,500. Add more above Rs 16,100, which will signal a confirmed breakout. While the Elliott target is Rs 23,530, from a market behavior perspective, Rs 20,000–Rs 20,500 will be a key review zone as speculative interest will increase significantly above Rs 20K, raising volatility and risk. While the overall technical and fundamental structure remains firmly bullish, some caution is prudent in the medium term. Sowing activity for the upcoming season has started off strong, and the Indian Meteorological Department (IMD) projects an above-normal monsoon, which may lead to increased turmeric acreage. Additionally, geopolitical tensions in the Middle East could inject unexpected volatility into agri-commodity markets through currency or trade impacts. However, these factors are not yet dominant and, at this stage, are secondary to the clear structural tightness in stock and the strong technical outlook. The broader price trend remains positive at least until the arrival of the new crop in February 2026.

Above views are of the author and not of the website kindly read disclaimer