The Economy Observer : Household net financial savings likely picked up in 1HFY25 by Motilal Oswal Financial Services Ltd

Household net financial savings likely picked up in 1HFY25

Growth in non-housing personal loans moderates, though still high

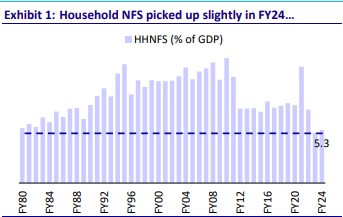

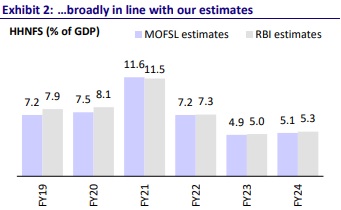

* The Reserve Bank of India (RBI) published updated data on FY24 household net financial savings (HHNFS) in its Dec’24 Bulletin. HHNFS improved slightly to 5.3% of GDP last year from a 47-year low of 5.0% of GDP in FY23 (Exhibit 1). Interestingly, the RBI has revised down its FY23 data from 5.1% reported earlier in Sep’23 and 5.3% published by the Central Statistics Office (CSO) in Feb’24. The small improvement in FY24 was broadly in line with our estimates1 , which suggested HHNFS at 5.1% of GDP in FY24 vs. 4.9% in the previous year (Exhibit 2).

* Details suggest that while gross financial savings (GFS) picked up in FY24, they were largely matched by higher liabilities, due to which there was only a marginal rise in HHNFS. GFS stood at 11.6% of GDP in FY24, better than 11.0% in the previous two years (FY22/FY23), although it was lower than the average of 12.0% of GDP in the pre-pandemic years (FY18-FY20). HH liabilities, on the other hand, were at a 17-year high of 6.4% of GDP, the second highest on record after 6.6% of GDP in FY07 (Exhibits 3 and 4).

* Our estimates suggest that HHNFS likely picked up to 7.3% of GDP in 1HFY25, almost double of that in 1HFY24 (Exhibit 5). About three-fifths of the improvement in HHNFS came due to lower liabilities, while GFS also increased. Our calculations suggest that financial liabilities were at 4.7% of GDP in 1HFY25, compared to 6.9% in 1HFY24, while GFS increased to 12.0% of GDP from 10.6%. Higher GFS was largely on account of insurance savings, a lower fall in currency holdings (led by withdrawal of 2,000 denomination banknotes last year) and investments in capital markets.

* The RBI data also revealed that household debt increased to 41.0% of GDP in FY24 from 37.9% of GDP in FY23. This is also comparable2 to our estimate of 42.9% of GDP last year. This compares with 31-32% of GDP a few years ago. Our updated data suggests that HH debt rose slightly to 43.5% of GDP in 1HFY25 (Exhibits 6 and 7).

* We classify HH debt into four segments – agriculture loans, businesses (industry and services), housing loan and nonhousing personal loans (NHPLs). Housing debt accounts for only ~30% of total HH debt in India, which means non-housing debt has risen to 32.3% of GDP as of 2QFY25, which is among the highest compared to others (Exhibits 8 and 9).

* Details3 – based on our estimates – confirm that the share of NHPLs increased to a one-third of total HH debt in 1HFY25, compared to 29% each in FY20 and FY21 (Exhibits 10 and 11). This is because such loans grew 20.6% YoY in 1HFY25, slower than 25%/23% YoY in FY23/FY24, but much higher than 13-14% growth in other segments of HH debt (i.e., agriculture, businesses and housing loans).

* Within NHPLs, secured loans (vehicles, consumer durables, gold, loans against fixed deposits [FDs] and loans against shares, bonds [SBs] etc.) grew at a six-quarter high rate of 21.7% YoY in 2QFY25, faster than 11-quarter slow growth of 19.9% YoY in unsecured loans (all others). The former, thus, grew faster than the latter for the first time in 11 quarters. Unsecured personal loans accounted for 19.7% of HH debt in 1HFY25 or about three-fifths of total HH debt vs. 13% or about half of total HH debt in FY19 (Exhibits 12 and 13).

* Within secured loans, loans against gold jewelry increased by a 13-quarter high rate of 34.9% YoY in 2QFY25, compared to ~20% YoY growth in vehicles and consumer durables. Based on available details of NHPLs, vehicle loans account for about a fourth of such loans, other loans account for about half, and the remaining loans (education, consumer durables, gold loans, loans against FDs, shares, bonds, etc. and credit cards) account for the rest of NHPLs (Exhibits 14 and 15).

* Overall, the RBI’s actions to restrict very high growth in unsecured NHPLs seem to be working. Our estimates suggest that the growth in unsecured PLs moderated from the high of 31.3% YoY in 3QFY24 to 19.9% YoY in 2QFY25. This must have had some adverse impact on consumers’ spending power as well. Nonetheless, it is still higher than 15.8% YoY growth in total HH debt and much higher than ~14% growth each in the agricultural and business (in the household sector) portfolios. The story is still unfolding and we will keep a close eye on these trends.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

The Economy Observer Dec`24 CPI inflation down to a four-month low of 5.2% by Motilal Oswal ...