Technical Forecast : Nifty ends above the 25000 zone by Vaishali Parekh, Vice President - Technical Research at PL Capital

Market Preview

Nifty ends above 25000 zone

Nifty witnessed another day of robust move moving past the important SOEMA at 24900 level and also the 25000 zone which was very important with bias overall turning optimistic. BankNifty continued with the positive move gaining further to close above the 56000 zone with sentiment easing out anticipating for further fresh upward move in the coming days. The market breadth was overall flat with the advance decline indicating a neutral ratio at close

Market Forecast

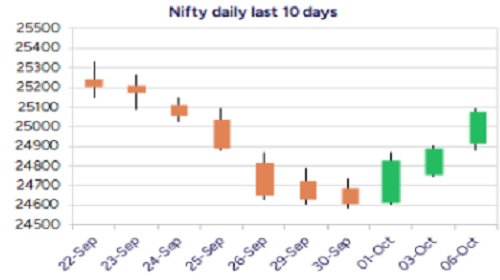

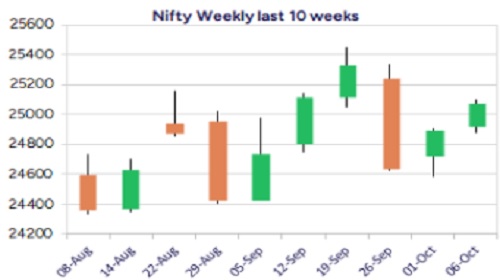

Nifty daily range 24950-25300

Nifty, continued with the positive move further ahead with a bullish candle formation on the daily chart moving past the significant 50EMA at 24900 zone decisively to improve the bias and closed the session above the 25000 level which was important with respect to sentiment which is beginning to turn optimistic from here on. The index, as mentioned earlier, a decisive move above the near-term hurdle of 25250 level shall further establish conviction and clarity to anticipate for further rise in the coming days with next target of 25700 level achievable. BankNifty, witnessed a robust move to close above the 56000-zone indicating a breakout above the neckline of the Inverted Head & Shoulder pattern at 55700 level to improve the bias and trigger for fresh upward move having targets of 57700 and 58500 levels in the coming days. The RSI is on the rise indicating strength and with the bias and sentiment getting better in the last 3 sessions, one can anticipate for further gains soon, with 55000 zone positioned as the near-term support

The support for the day is seen at 24950 levels, while the resistance is seen at 25300 levels. BankNifty would have the daily range of 55700-56800 levels

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

More News

Daily Market Commentary : Market upbeat as U.S. President signals progress in India trade ta...