TeamLease Services Results for Q1FY26

TeamLease Services Limited (NSE: TEAMLEASE, BSE: 539658), one of India’s largest staffing companies, today announced its results for the first quarter (Q1FY26) of the financial year ending March 31, 2026.

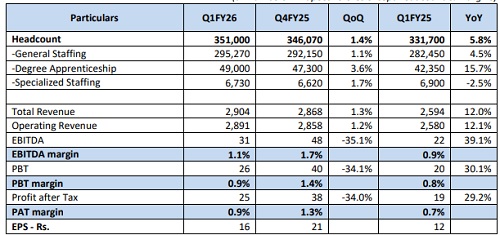

Summary of Consolidated Financial Results

Highlights of Q1FY26:

1) At the group level, we have added ~5k headcount including 110 net adds in specialized staffing business.

2) On a year-on-year basis, we have added ~19k associates despite headwinds in BFSI and IT services.

3) EBITDA grew by 39% YoY, backed by consistent operative leverage and volume growth

4) Net free cash stands at Rs.300cr, excluding TDS refundable of ~Rs.300cr

5) 118 new logos were added during the quarter

General Staffing

* Headcount grew by 5% on YoY basis and Revenue up by 11% on YoY

* 44 new logos added with more than 60% under the variable model

* DSO of 7 days and funding stays at 14% of the volume

Degree Apprenticeship (DA)

* DA saw a net add of 1700 headcount for the quarter

* 14 new logos were added during the quarter and 22% of the total client’s base have fully adopted learning solutions

Specialized Staffing

* Gross revenue grew by 22% on YoY basis including inorganic contribution. Organic YoY growth is 13%

* 110 net adds during the quarter including 20 net adds from TLD Singapore

* GCC segment remains a cornerstone of our business, both in terms of volume and stability contributing approximately 46% of headcount and 64% of net revenue

* TLD now serves 75 GCC clients with high activity in BFSI, Healthcare, HiTech, and Engineering.

HR Services

* QoQ EBITDA got impacted on account of the seasonality aspect of the EdTech business

* Managing over 3.5 lakhs monthly records in our HCM business

Management Comment

Mr. Ashok Reddy, Managing Director, TeamLease Services Limited commenting on the quarterly results said, “Despite persistent macro-economic headwinds affecting the BFSI and IT services verticals, we have delivered notable EBITDA growth on a year-on-year basis. Resilient demand from enterprise clients and tech profiles in Non-tech companies and Global Capability Centers, have helped sustain the growth momentum. With a sharp focus on operational efficiency, diversified service mix and financial discipline, we are gearing up for a steady profit expansion trajectory for the remainder of the fiscal year and delivering value to all stakeholders across business cycles.”

Above views are of the author and not of the website kindly read disclaimer