Strategy : On equities and gold by Kotak Institutional Equities

On equities and (or) gold

The strong performance of gold and the lackluster performance of equities over the past one year have reignited the “equities versus gold” debate. The debate may be somewhat pointless, given the different ‘roles’ of equities (investment) and gold (insurance) within household savings. The real issue of high gold imports and its macro implications for India is largely ignored.

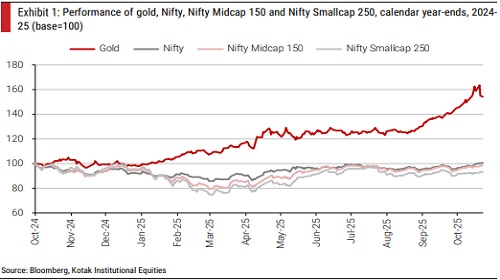

Strong performance of gold versus weak performance of Indian equities

The strong performance of gold and the weak performance of Indian equities over the past 12 months (see Exhibit 1) may tempt Indian households to put a larger share of household savings into gold. This may further derail India’s current account and trade deficits, as India does not produce any gold. Exhibit 2 shows India’s net gold imports relative to its current and trade deficits for the past 15 years. Exhibit 3 shows the key components of India’s BoP accounts for the past few years. Indian households may have reasons such as (1) inflation and (2) insurance to invest in non-productive imported assets. In the absence of any counterfactual evidence (what if Indian households had not bought gold?), we can only mentally debate causation and correlation.

FOMO driving gold prices? ‘Debasement’ and other arguments seem weak

As discussed in our October 7, 2025 report, (when haven and risky assets are on a tear), we would attribute the sharp rise in gold prices to strong investment demand (see Exhibit 4 for the breakdown of global gold demand). The other arguments for the sharp increase in gold prices—(1) central banks diversifying their holdings from US dollar assets to gold, (2) countries ‘debasing’ their currencies inadvertently through ‘reckless’ fiscal policies (high fiscal deficits and high leverage), (3) households worrying about a sharp increase in inflation and (4) households being nervous about geopolitical and other catastrophes— do not stack up against data (see Exhibits 5-9).

Indians buying Indian equities and gold, foreigners selling equities and gold

The purchase of gold and precious stones by Indian households (net basis; imports less exports of gold and precious stones in jewelry) far exceeds the FPI investment in debt and equity over the past 15 years (see Exhibit 10). In fact, FPIs have been net sellers of equities for the past few years, while DIIs (in reality, Indian households) have been large buyers of equities (see Exhibits 11-12). The large selling by FPI and FDI (PE, foreign promoter and strategic shareholders) investors has aggravated India’s BoP and FDI positions (see Exhibits 13-15).

Low ‘wealth effect’ of gold holdings on consumption, given the nature of holding

We do not see any material impact on consumption of ‘wealth effect’, despite the sharp increase in value of gold holdings of Indian households (see Exhibit 16 for our rough estimate). We note that the gold holding of Indian households is (1) owned largely by low-income households (see Exhibit 17), (2) held as insurance against exigencies and (3) used for specific big-ticket spending (education and weddings).

Tailpiece

How many current billionaires have made their wealth from investing in equities and how many from investing in gold?

Gold has outperformed equities over the past 12 months

Please refer disclaimer at https://www.kotaksecurities.com/disclaimer

SEBI Registration No. INZ000200137