Gold hit a record $4,185 an ounce amid US-China tensions and likely two more Fed rate cuts this year - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

Gold soared to an all-time high of $4,185 an ounce, driven by rising US-China tensions and expectations of two more Fed rate cuts this year. Silver also spiked past $53.54 before retreating amid easing supply pressures. Yields on US Treasuries fell to the lowest levels in weeks on Tuesday, after Fed Chair Jerome Powell signaled the US central bank is on track to deliver another quarter-point cut later this month. Lower yields and borrowing costs tend to benefit precious metals, which don’t pay interest.

Meanwhile, risk-off sentiment swept markets — boosting gold’s haven appeal — after President Donald Trump said he might stop trade in cooking oil with China.

Oil stabilized after hitting a five-month low, pressured by oversupply fears and deepening USChina trade tensions. Brent hovered around $62 a barrel, while WTI dipped below $59. The International Energy Agency said on Tuesday the global oil market will be oversupplied by almost 4 million barrels a day next year, an increase of nearly a fifth from its previous forecast. Oil has shed about 17% this year as a bid by the OPEC+ alliance to regain market share by returning shuttered production faster than expected added to the concerns of oversupply.

Zinc fell the most in nearly eight months as China, the top producer, moves to export the metal. A widening price gap—high in London, low in Shanghai—highlights a split market: surging global prices amid tight supply, versus rising output and sluggish demand in China

Top copper producer Codelco aims to set a $325-per-ton premium for key European buyers, while Aurubis plans a nearly 40% hike, raising its 2025 premium to $315. The moves reflect tight supply and strong demand expectations in the region.

Asian stocks rebounded after a three-day slump, buoyed by hopes of a Fed rate cut, which offset lingering US-China trade tensions and lifted market sentiment.

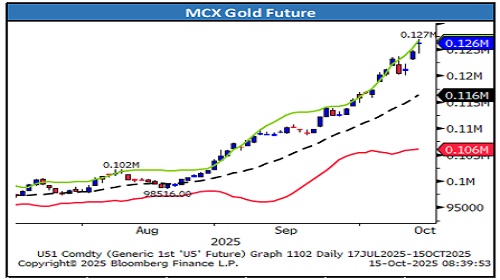

Gold

* Trading Range: 124000 to 128250

* Intraday Trading Strategy: Buy Gold Dec Fut at 125500-125100 SL 124800 Target 127100

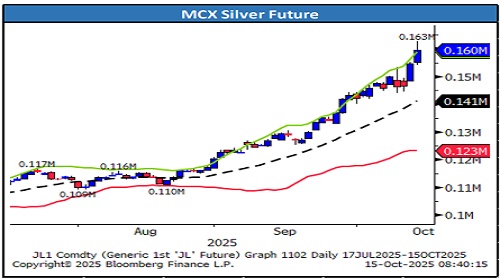

Silver

* Trading Range: 153000 to 164000

* Intraday Trading Strategy: Buy Silver Dec. Fut. At 159000-159300 SL 158300 Target 162900

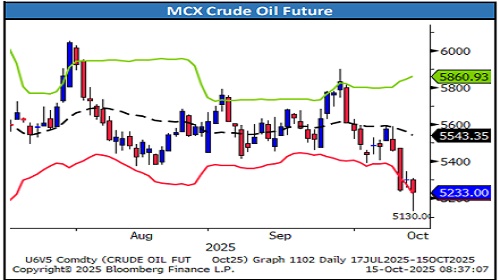

Crude Oil

* Trading Range: 5130 to 5540

* Intraday Trading Strategy: Sell Crude Oil Oct Fut between 5280-5330 SL 5370 Target 5130

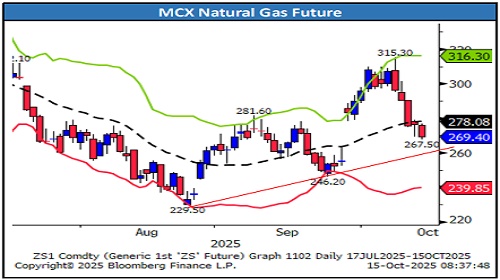

Natural Gas

* Trading Range: 260 to 280

* Intraday Trading Strategy: Sell Natural Gas Oct Fut at 273 SL 278 Target 265

Copper

* Trading Range: 970 to 1030

* Intraday Trading Strategy: Buy Copper Oct Fut at 985 SL 970 Target 1010

Zinc

* Trading Range: 285 to 298

* Intraday Trading Strategy: Buy Zinc Oct Fut at 288 SL 285 Target 293

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133