Gold hit record high on US-China tensions and hopes of more Fed rate cuts - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

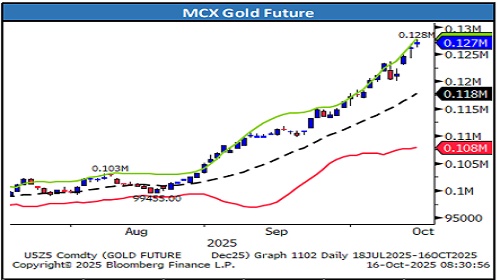

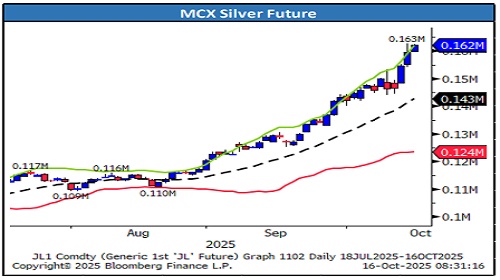

Gold soared to an all-time high, fueled by escalating US-China tensions and expectations of continued Federal Reserve rate cuts. Prices jumped over 5% this week, peaking above $4241 an ounce amid a fast-paced rally since mid-August. Silver also spiked over 3% on tight supply in London. Traders are increasingly betting on aggressive Fed easing by year-end, as lower rates boost appeal for non-yielding assets like bullion.

President Trump’s declaration of a trade war with China stoked global economic fears, driving demand for gold as a safe haven. Despite Treasury Secretary Scott Bessent suggesting a tariff pause, market anxiety lingered. The prolonged US government shutdown and rising concerns over fiscal deficits have also pushed investors toward gold, favoring it over sovereign debt and currencies. Central banks’ strong gold purchases further supported a rally, with bullion up over 60% this year.

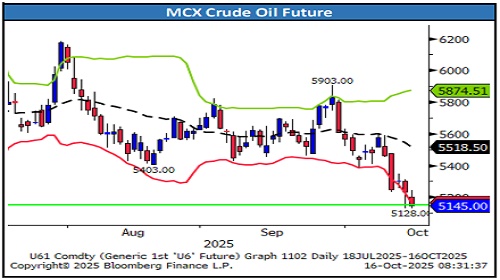

Oil rebounded from a five-month low after President Trump stated that India’s Prime Minister Modi pledged to stop buying Russian crude, potentially tightening global supply. Brent climbed above $62 a barrel, while WTI hovered near $59. However, Trump gave no timeline, and India has yet to confirm the move officially. India could boost its US oil imports by an extra $15 billion, according to a senior commerce ministry official. Current energy purchases average $12–$13 billion based on FY25 data. Additionally, India is eyeing around $40 billion in major acquisitions from the US to help trim its trade surplus.

Copper’s rally is prompting Chinese smelters to boost exports, attracted by near-record London prices as domestic demand falters due to high costs. Two major smelters plan to ship up to 25,000 tons to LME-linked bonded warehouses and Asian depots in the coming weeks, according to sources familiar with the matter.

Asian stocks climbed after a turbulent US trading session ended in gains, with investors assessing fresh US-China trade tensions. The S&P 500 swung sharply on Wednesday—rising as much as 1.2% before paring gains to close up 0.4%.

Gold

* Trading Range: 124000 to 128250

* Intraday Trading Strategy: Buy Gold Dec Fut at 127200-127300 SL 127050 Target 127900

Silver

* Trading Range: 156000 to 164000

* Intraday Trading Strategy: Buy Silver Dec. Fut. At 162000-161800 SL 161500 Target 163200

Curde Oil

* Trading Range: 5050 to 5400

* Intraday Trading Strategy: Sell Crude Oil Oct Fut between 5180-5210 SL 5250 Target 5030

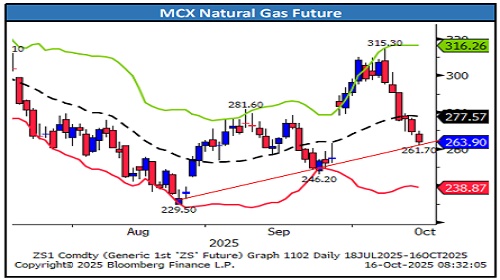

Natural Gas

* Trading Range: 247 to 275

* Intraday Trading Strategy: Buy Natural Gas Oct Fut at 264 SL 259 Target 271

Copper

* Trading Range: 970 to 1030

* Intraday Trading Strategy: Buy Copper Oct Fut at 985 SL 970 Target 1010

Zinc

* Trading Range: 285 to 298

* Intraday Trading Strategy: Sell Zinc Oct Fut at 290 SL 294 Target 285

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133