Stocks in News & Key Economic Updates 13th Feb 2026 by GEPL Capital Ltd

Stocks in News

* INFOSYS: The company has expanded its partnership with ExxonMobil to develop AI infrastructure solutions and advanced data center immersion cooling fluids.

* AU SMALL FINANCE BANK: RBI has approved the reappointment of Sanjay Agarwal as Managing Director and CEO for a three-year term.

* GAIL INDIA: The company has appointed Deepak Gupta as Chairman and Managing Director for a term ending February 28, 2029.

* CESC: Purvah Green Power, a subsidiary of the company, has received a Letter of Award from SECI for wind power projects.

* NATCO PHARMA: The company plans to set up a subsidiary in Chile with a $300,000 investment and has appointed Amit Parekh as Chief Financial Officer.

* HCC: The company’s joint venture has secured Rs.578 crore railway contract from Northeast Frontier Railway.

* GODAWARI POWER: The company has received environmental clearance to expand capacity at its Chhattisgarh plant.

* HEXAWARE TECH: The company has partnered with CareInsight to accelerate AI-driven transformation in healthcare.

* NEOGEN CHEMICALS: The company has received an additional Rs.60 crore insurance claim for the March 2025 Dahej fire, taking total receipts to Rs.140 crore.

* ONIX SOLAR: The company will raise Rs.250 crore through a rights issue of 45.8 lakh shares at Rs.546 per share, with February 18 set as the record date.

Economic News

* Inflation Returns to Target Band Under New CPI Series: India’s retail inflation rose to 2.75% in January under the revised CPI series (base year 2024), returning to the RBI’s 2–6% target band for the first time since August and exceeding the 2.4% Reuters estimate. The new series reduces food weightage to ~37% from ~46%, expands categories to 13, and includes e-commerce, digital services, airfare and telecom, better reflecting evolving consumption trends. Food inflation stood at 2.13% YoY, though items like tomatoes (+64.8%) and gold/platinum jewellery (+46.8%) saw sharp spikes. With inflation benign and growth projected at 6.8–7.2% in FY27, the RBI, despite recent rate cuts, may stay on pause, as core inflation (~3%) and aggregate demand dynamics increasingly shape policy, while tax cuts and the interim US trade deal support stability.

Global News

* UK Economy Barely Expands in Q4 : The UK economy grew just 0.1% in Q4, below the 0.2% estimate and matching Q3’s pace, while December GDP rose 0.1% month-on-month. Services stagnated, manufacturing drove limited growth, and construction posted its weakest performance in over four years. The economy expanded 1.3% in 2025 after 1.1% growth in 2024. With rates held at 3.75% amid sticky inflation, the Bank of England could consider a cut in April as price pressures ease. While recent data signals a potential recovery in 2026, supported by improving manufacturing and services activity, concerns over a slowing jobs market and persistent inflation remain.

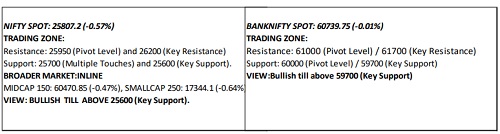

Technical Snapshot

Key Highlights:

Government Security Market:

* The Inter-bank call money rate traded in the range of 4.40%- 5.10% on Thursday ended at 4.65%.

* The 10 year benchmark closed at 6.6833% on Thursday Vs 6.7088% on Wednesday .

Global Debt Market:

U.S. Treasury yields moved lower on Thursday as investors awaited more labor market data and looked ahead to the key inflation report. At 6:18 a.m. ET, the 10- year Treasury yield was down 1 basis point to 4.173%, and the 30-year Treasury yield fell 1.5 basis points to 4.799%. The 2-year Treasury note yield was less than a basis point lower at 3.51%. Investors are still weighing the January nonfarm payrolls report, which showed job growth of 130,000 last month, coming in above Dow Jones’ economists’ expectations of 55,000, and much higher than December. The unemployment rate moved lower to 4.3% from 4.4%. The report came as a relief to investors, as concerns about the labor market were mounting, with recent data showing slower growth. The consumer price index will be a key focus for investors on Friday as they seek more clarity on price pressures. “It’s going to put a lot of weight on Friday’s CPI report, because if that comes in tame, at least the market can understand that the inflation part of the Fed’s equation is cooling,” Fundstrat Global Advisors head of research Tom Lee told CNBC’s “Closing Bell” on Wednesday. “And of course, now, if the job market is showing decent strength, it kind of relieves us from a macro perspective, because at least we’re not seeing an economic downturn,” Lee added. Investors will also be awaiting more labor market data on Thursday, with the weekly initial jobless claims due and existing home sales at 10 a.m.

10 Year Benchmark Technical View :

The 10 year Benchmark (6.48% GS 2035) yield likely to move in the range of 6.67% to 6.70% level on Friday.

SEBI Registration number is INH000000081.

Please refer disclaimer at https://geplcapital.com/term-disclaimer