Spot gold may rise to $4250 on weak dollar and safe-haven demand -ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and move towards $4250 level on weak dollar and safe haven demand. Further, prices may rally amid growing probability of December rate cut. As per CME Fed-Watch tool traders are now pricing almost 87% chance of a rate cut in December, up from 84% a week ago. Moreover, prices may get support on safe haven buying and strong central bank demand. Further delay in Russia and Ukraine peace negotiation would also support prices. Meanwhile, investor will eye on US core PCE price index data which could bring further clarity on Fed’s next move. A softer inflation numbers would increase the chances of December rate cut. .

* MCX Gold Feb is expected to rise towards Rs.131,500 level as long as it stays above Rs.129,000 level. Only a move below Rs.129,000 it would fall towards Rs.128,000.

* MCX Silver March is expected to rise towards Rs.183,000 level as long as it stays above Rs.176,400 level. A move above Rs.183,000, would open the doors towards Rs.185,000.

Base Metal Outlook

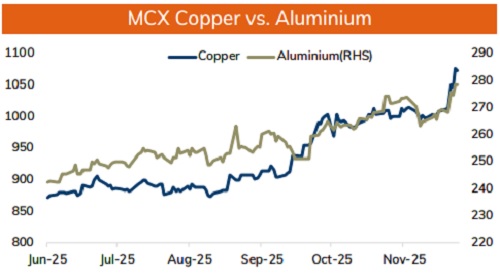

* Copper prices are expected to hold its gains and move higher on concerns over supply shortage. A drop in Chilean production and expectation of drop in production from Kamoa-Kakula complex in the Democratic Republic of Congo would hurt global supplies. Moreover, depleting inventory levels in LME, which hit its lowest since July has heightened supply concern. Meanwhile, weaker than expected economic numbers from China would weigh on prices

* MCX Copper Dec is expected to hold support near Rs.1060 move higher towards Rs.1080 level. Only break below Rs.1060 level it may fall towards Rs.1050-Rs.1045 level.

* MCX Aluminum Dec is expected to rise towards Rs.280 level as long as it stays above Rs.274 level. MCX Zinc Dec is likely to move in the wide range of Rs.305 level and Rs.310 level. Only above Rs.310 it would open the doors towards Rs.314.

Energy Outlook

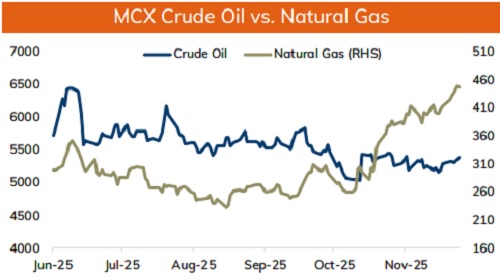

* Crude oil prices are positioned to find support near $58 per barrel and likely advance toward the $60 mark, primarily driven by intensifying global supply risks and geopolitical tensions. Recent attacks on Russian oil infrastructure may hinder peace talks, raising concerns over the stability of Russian oil supplies. Simultaneously, ongoing tensions between the United States and Venezuela pose another significant threat to the global supply chain. Meanwhile, Saudi Arabia has lowered its prices for Asian countries which could check the upside in price move.

* MCX Crude oil Dec is likely to hold support near Rs.5240 level and move higher towards Rs.5400 level. Only a move above Rs.5400 it would turn bullish towards Rs.5500.

* MCX Natural gas Dec is expected to rise towards Rs.455 level as long as it stays above Rs.440 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)