Gold stayed steady on US easing hopes; silver hovered near $64.31 - HDFC Sescurities Ltd

GLOBAL MARKET ROUND UP

* Gold remained steady after three consecutive days of gains, supported by expectations of further monetary easing in the US following a recent rate cut, while Silver traded near its record high of $64.3120 an ounce reached on Thursday. Bullion was little changed near $4,280 an ounce; its price strength is underpinned by swap traders betting on two Federal Reserve rate reductions in 2026, despite the central bank signaling only one, and is further reflected by the sustained rise in holdings of gold-backed ETFs. Silver's surge, meanwhile, is attributed to tight supply and growing demand, particularly from industrial sectors.

* Oil prices rallied from a two-month low, primarily supported by overall bullishness in the broader financial markets. However, this upside momentum faces a significant counterpressure from fundamentals, as the International Energy Agency (IEA) has reiterated its forecast for an unprecedented market surplus, noting that global inventories have swelled to a four-year high. Oil prices may find some additional, albeit limited, support from rising geopolitical tensions, including the imposition of new sanctions targeting Venezuelan individuals and oil tankers, which increase the risk and cost of moving crude.

* Copper surged to a fresh record high, settling up 2.7% at $11,872 a ton on the London Metal Exchange, as the base metals sector—excluding nickel—rallied. This climb was driven by increased market optimism after the Federal Reserve delivered a widely anticipated interestrate cut and significantly upgraded its outlook for the US economy, now projecting 2.3% growth next year and anticipating a moderation in inflation to 2.4%.

* Asian stocks surged, mirroring fresh records set by US and global equities, with investor sentiment overwhelmingly positive following the Federal Reserve's rate cut and its optimistic assessment of the US economy.

Gold

* Trading Range: 130200 to 134200

* Intraday Trading Strategy: Buy Gold Mini Jan Fut at 130500 SL 129900 Target 131500

Silver

* Trading Range: 195500 to 202200

* Intraday Trading Strategy: Buy Silver Mini Feb Fut at 197500 SL 196500 Target 199500

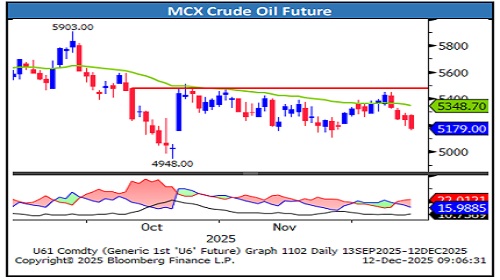

Crude Oil

* Trading Range: 5150 to 5350

* Intraday Trading Strategy: Buy Crude Oil Dec Fut at 5220 SL 5170 Target 5315

Natural Gas

* Trading Range: 360 to 407

* Intraday Trading Strategy: Sell Natural Gas Dec Fut on bounce at 390 SL 396 Target 382

Copper

* Trading Range: 1080 to 1130

* Intraday Trading Strategy: Buy Copper Dec Fut at 1095 SL 1080 Target 1125

Zinc

* Trading Range: 310 to 330

* Intraday Trading Strategy: Buy Zinc Dec Fut above 316 SL 311 Target 323

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133