South Africa Economy Update - June 2025 by CareEdge Ratings

Subdued Start to the Year

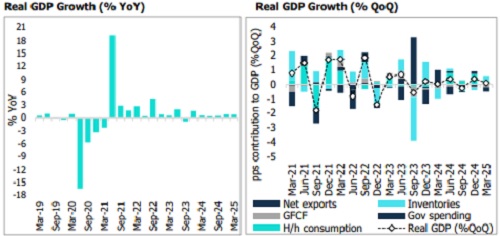

After recording subdued economic growth of 0.5% in 2024, South Africa’s real GDP edged up by 0.1% QoQ (0.8% YoY) in Q1 2025 from a downwardly revised growth of 0.4% QoQ in Q4 2024 (0.6% previously). Real GDP growth was driven by a rise in household (H/h) consumption and restocking, offsetting downbeat gross fixed capital formation (GFCF) and net exports.

Household consumption rose by 0.4% QoQ and contributed 0.3 percentage points (pps) while restocking added 0.3 pps to real GDP growth in Q1 2025. These outweighed weak GFCF, which fell by 1.7% QoQ, and a 2% QoQ increase in imports that outpaced export growth and meant that net exports deducted 0.3 pps from overall GDP growth. Government spending fell for the third consecutive quarter.

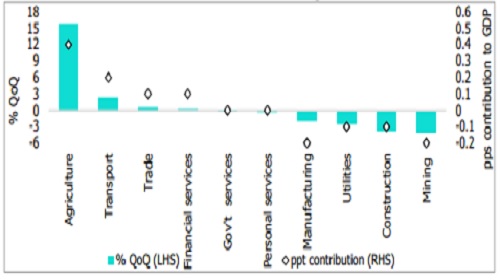

From a production perspective, four of the ten sectors recorded QoQ growth, offsetting declines in the other six sectors. Output in the agricultural sector rose by 15.8% QoQ, indicating the gains from improved climate conditions at the start of this year. Production in the transport sector also recorded strong gains, while there was a marginal uptick in the trade and financial services sectors. In contrast, output in the mining sector fell by 4.1% QoQ while there were sharp declines in the construction, utilities, and manufacturing sectors.

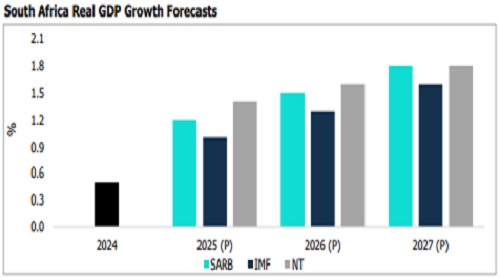

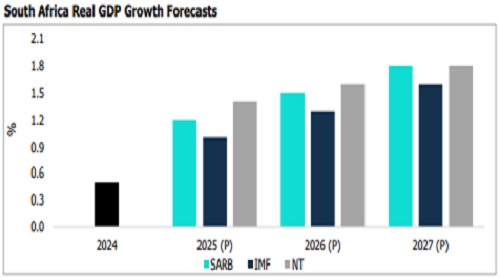

There have been downward revisions to real GDP forecasts. National Treasury (NT) expects real GDP to rise by 1.4% (1.8% previously) in 2025, 1.6% in 2026 (1.7% previously) and 1.8% in 2027 (1.9% previously). The South African Reserve Bank (SARB), meanwhile, projects real GDP growth of 1.2% in 2025 (1.7% previously), 1.5% in 2026 (1.8% previously) and 1.8% in 2027 (2% previously). The SARB remains optimistic about structural reforms but highlighted that lower global growth presents headwinds.

Weak Economic Activity Weighs on the Labour Market

The latest Quarterly Labour Force Survey (QLFS) showed that the unemployment rate worsened to 32.9% in Q1 2025 from 31.9% in Q4, reflecting sluggishness in the job market amid weak economic activity, while new entrants into the labour market also contributed to the deterioration in the unemployment figures. Overall, unemployed individuals rose by 3% to 8.2 million. Job losses were mainly recorded in the formal sector, with 245,000 jobs being lost, offsetting job growth in the informal sector.

Looking ahead, we expect the labour market to gradually improve from these depressed levels as the impact of reforms starts to transmit to the broader economy and yield employment gains. However, slowing global growth amid protectionist measures and US tariffs will limit the magnitude of improvement in the labour market, particularly in the manufacturing and agricultural sectors.

FY26 Budget 2.0 Highlights

The whirlwind ride endured by South Africa’s FY261 Budget finally came to a conclusion when it was retabled by the Minister of Finance on May 21 (see our report, South Africa FY26 Budget 2.0, for more details). The re-tabled FY26 Budget continued highlighting NT’s focus on fiscal consolidation and the government's intention to implement reforms and boost investments to generate faster growth.

The gap left by the withdrawal of the VAT rate increase proposal was partially offset by an increase in the fuel levy for the first time since FY22, while other tax revenue measures will be announced in the FY27 Budget. Gross tax revenue is projected to increase by 7% YoY in FY26 and rise at an annual average of 7.2% over the medium term (FY26-FY28). PIT is estimated to do most of the heavy lifting, rising by 7.5% over the medium term (FY26-FY28), while VAT is estimated to account for 24.1% of gross tax revenue. Overall, NT estimates gross tax revenue to gradually climb to 25.7% of GDP in FY28 and alongside nontax revenue measures, total revenue is expected to reach 28.2% of GDP by FY28.

In terms of expenditure, consolidated expenditure is projected to rise by 7.5% YoY in FY26 before easing sharply in FY27. It is estimated to increase by an annual average growth rate of 5.4% over the medium term (FY26-FY28). Overall, annual expenditure estimates have been reduced by around ZAR 23 billion, on average, over the medium term (FY26-FY28) relative to the forecast presented in the March 2025 Budget. Risks to expenditure remain tilted to the upside, especially considering that the Social Relief of Distress (SRD) grant has not been extended beyond FY26. At the same time, the contingency reserves have been significantly reduced, which hinders NT's ability to respond to unplanned spending pressures.

Looking ahead, we expect the labour market to gradually improve from these depressed levels as the impact of reforms starts to transmit to the broader economy and yield employment gains. However, slowing global growth amid protectionist measures and US tariffs will limit the magnitude of improvement in the labour market, particularly in the manufacturing and agricultural sectors.

FY26 Budget 2.0 Highlights

The whirlwind ride endured by South Africa’s FY261 Budget finally came to a conclusion when it was retabled by the Minister of Finance on May 21 (see our report, South Africa FY26 Budget 2.0, for more details). The re-tabled FY26 Budget continued highlighting NT’s focus on fiscal consolidation and the government's intention to implement reforms and boost investments to generate faster growth.

The gap left by the withdrawal of the VAT rate increase proposal was partially offset by an increase in the fuel levy for the first time since FY22, while other tax revenue measures will be announced in the FY27 Budget. Gross tax revenue is projected to increase by 7% YoY in FY26 and rise at an annual average of 7.2% over the medium term (FY26-FY28). PIT is estimated to do most of the heavy lifting, rising by 7.5% over the medium term (FY26-FY28), while VAT is estimated to account for 24.1% of gross tax revenue. Overall, NT estimates gross tax revenue to gradually climb to 25.7% of GDP in FY28 and alongside nontax revenue measures, total revenue is expected to reach 28.2% of GDP by FY28.

In terms of expenditure, consolidated expenditure is projected to rise by 7.5% YoY in FY26 before easing sharply in FY27. It is estimated to increase by an annual average growth rate of 5.4% over the medium term (FY26-FY28). Overall, annual expenditure estimates have been reduced by around ZAR 23 billion, on average, over the medium term (FY26-FY28) relative to the forecast presented in the March 2025 Budget. Risks to expenditure remain tilted to the upside, especially considering that the Social Relief of Distress (SRD) grant has not been extended beyond FY26. At the same time, the contingency reserves have been significantly reduced, which hinders NT's ability to respond to unplanned spending pressures.

The FY26 Budget continued to emphasize the National Treasury’s (NT) commitment to fiscal consolidation. Following the downward revision to the growth outlook and the withdrawal of the VAT rate increase, the fiscal deficit to GDP ratio is estimated 0.2pps higher in FY26 at 4.8% of GDP, relative to the estimate presented in the March 2025 Budget. The fiscal deficit to GDP ratio is projected to narrow to 3.4% in FY28.

The biggest concern, however, stems from the worsening in South Africa’s debt-to-GDP ratio, which is now projected to peak at 77.4% in FY26. Concerns regarding the debt profile are further fuelled by the NT providing a government guarantee to Transnet, the state-owned Logistics Company, worth ZAR 51 billion (0.6% of GDP) over FY26 and FY27 to help the State-Owned Entity (SOE) service its debt.

Above views are of the author and not of the website kindly read disclaimer