Shree Cement inches up on inking asset purchase agreement with Starcrete

Shree Cement is currently trading at Rs. 25027.35, up by 84.85 points or 0.34% from its previous closing of Rs. 24942.50 on the BSE.

The scrip opened at Rs. 24986.80 and has touched a high and low of Rs. 25485.85 and Rs. 24942.45 respectively. So far 171 shares were traded on the counter.

The BSE group 'A' stock of face value Rs. 10 has touched a 52 week high of Rs. 30710.15 on 01-Feb-2024 and a 52 week low of Rs. 22601.30 on 26-Jun-2023.

Last one week high and low of the scrip stood at Rs. 25485.85 and Rs. 24570.10 respectively. The current market cap of the company is Rs. 89994.41 crore.

The promoters holding in the company stood at 62.55%, while Institutions and Non-Institutions held 24.85% and 12.60% respectively.

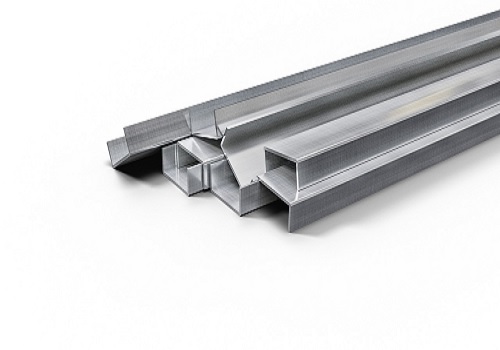

Shree Cement has signed an asset purchase agreement with Starcrete LLP, a limited liability partnership registered in Mumbai, to acquire 5 operational Ready-Mix Cement (RMC) plants, under an Asset Purchase Agreement, having an aggregate capacity of 422 CUM/hr at an aggregate consideration of Rs 33.50 crore. These plants are located in high growth RMC markets of Mumbai Metropolitan Region (MMR).

With this asset purchase, the company has announced its foray into the RMC business. The strategic location of the RMC plants will facilitate entry into key construction projects in MMR and help in growth of the RMC business of the company. The company is actively working on setting up Greenfield RMC plants at different locations. By end of March 2024, the company also aims to mark its Greenfield footprint in RMC business.

Shree Cement is engaged in the manufacturing and selling of cement and cement related products. It is recognized as one of the most efficient and environment friendly company in the global cement industry.