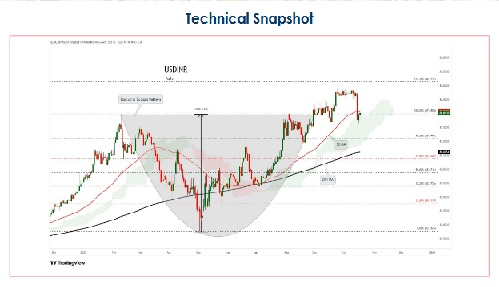

SELL USDINR OCT @ 87.95 SL 88.1 TGT 87.8-87.7 Kedia Advisory

USDINR

SELL USDINR OCT @ 87.95 SL 88.1 TGT 87.8-87.7

Observations

USDINR trading range for the day is 87.62-88.18.

Rupee hovering near a one-month high, as traders weighed the aftereffects of last week’s

aggressive RBI interventions.

US President Trump warns that tariffs will remain on Indian imports unless they halt buying oil

from Russia.

India's foreign exchange reserves dipped to $697.78 billion as of October 10, a slight decrease

from $699.96 billion the previous week

EURINR

SELL EURINR OCT @ 102.6 SL 102.9 TGT 102.3-102.

Observations

EURINR trading range for the day is 102.34-103.

Euro dropped as investors weighed the impact of S&P Global Ratings’ downgrade of France

against improving global risk sentiment.

S&P cut France’s sovereign rating to A+ from AA-, citing heightened risks to fiscal consolidation

and persistent uncertainty surrounding government finances.

Investors are awaiting the delayed US inflation data due Friday for further insight into the

Federal Reserve’s rate-cut trajectory.

GBPINR

SELL GBPINR OCT @ 118 SL 118.3 TGT 117.7-117.4.

Observations

GBPINR trading range for the day is 117.49-118.67.

GBP dropped as disappointing UK employment details fueled speculations that the BoE could

continue cutting rates gradually.

Worries about the UK’s fiscal outlook ahead of the crucial Autumn budget in November act as

a headwind

The UK economy grew 0.1% in August, rebounding from a 0.1% contraction in July.

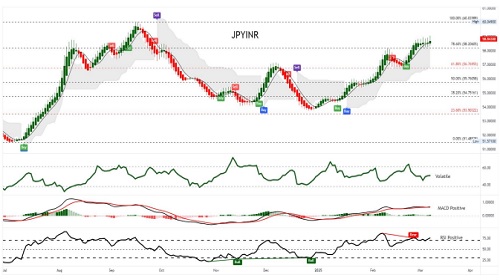

JPYINR

SELL JPYINR OCT @ 58.5 SL 58.8 TGT 58.2-58.

Observations

JPYINR trading range for the day is 58.05-59.11.

JPY weakened as investors prepared for Japan’s leadership vote on Tuesday that will decide

the country’s next prime minister.

Sentiment was shaped by news that the ruling Liberal Democratic Party and the Japan

Innovation Party agreed to form a coalition government.

Investors also looked ahead to Bank of Japan meeting, where policymakers are widely

expected to keep rates unchanged.

.jpg)