SELL SILVER MAR @ 239000 SL 241000 TGT 236800-235500. MCX - Kedia Advisory

Gold

SELL GOLD APR @ 154400 SL 155400 TGT 152600-151600. MCX

Observations

Gold trading range for the day is 145035-162645.

Gold fell as strong US jobs data boosted the dollar and lowered rate cut expectations.

US job growth accelerated unexpectedly in January and the unemployment rate edged down to 4.3%.

China's central bank extended its gold buying spree for a 15th month in January.

Investors are now awaiting Friday’s US consumer price index report for further insights.

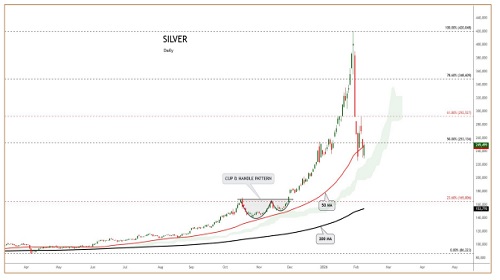

Silver

SELL SILVER MAR @ 239000 SL 241000 TGT 236800-235500. MCX

Observations

Silver trading range for the day is 216590-272700.

Silver dropped after stronger-than-expected US labor market data dampened expectations for near-term Fed rate cuts.

Nonfarm payrolls increased by 130K in January, more than double consensus forecasts and a sharp acceleration from December.

Silver inventories stood at 318.546 tonnes as of Feb 9, 2026, down from 349.900 tonnes reported on Feb 6, 2026, CEIC data.

As at end January 2026, the amount of silver held in London vaults was 27,729 tonnes, a 0.3% decrease on previous month.