Sell JPYINR FEB @ 59.3 SL 59.6 TGT 59-58.7 - Kedia Advisory

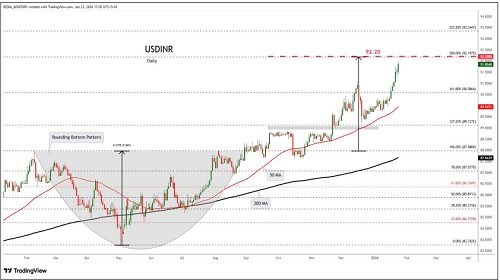

USDINR

SELL USDINR FEB @ 91.6 SL 91.8 TGT 91.3-91.1.

Observations

USDINR trading range for the day is 91.23-92.25.

Rupee rose to around 91.6, extending gains from the previous session, after early pre-market intervention by the Reserve Bank of India.

India's manufacturing activity inched up to 55.4 in January as demand improved slightly but the gain wasn't strong enough to lift business optimism.

The federal budget’s record borrowing of 17.2 trillion rupees and higher taxes on equity derivatives reinforced investor caution.

EURINR

SELL EURINR FEB @ 108.8 SL 109 TGT 108.5-108.2.

Observations

EURINR trading range for the day is 108.18-109.84.

Euro dropped as global risk sentiment deteriorated following a tumultuous selloff in precious metals

The euro zone economy grew quicker than expected last quarter as consumption and investments kicked into higher gear.

Euro zone consumers raised their longer-term inflation expectations to a record high in December.

GBPINR

SELL GBPINR FEB @ 125.6 SL 125.9 TGT 125.2-124.8.

Observations

GBPINR trading range for the day is 124.83-126.43.

GBP dropped as easing concerns over the Fed’s independence and hotter PPI inflation underpin the US

Dollar British businesses are most likely to be planning to raise pay this year by between 3% and 3.49%.

British entrepreneurs' negativity about the economic outlook reduced at the start of 2026, rising to its highest since May.

JPYINR

SELL JPYINR FEB @ 59.3 SL 59.6 TGT 59-58.7.

Observations

JPYINR trading range for the day is 59.14-59.58.

JPY depreciated after PM Takaichi said that a weak yen could be a major opportunity for export industries, signaling support for a softer currency.

BOJ’s risk of falling behind the curve has not increased markedly, a summary of opinions at its January meeting showed.

The S&P Global Japan Manufacturing PMI stood at 51.5 in January 2026, up from December’s final figure of 50.