SELL COPPER FEB @ 1212 SL 1220 TGT 1202-1192. MCX - Kedia Advisory

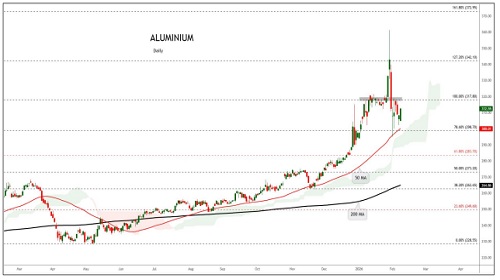

Aluminium

SELL ALUMINIUM FEB @ 309 SL 312 TGT 306-303. MCX

Observations

Aluminium trading range for the day is 298.3-320.1.

Aluminium dropped on profit booking after investors compared strong non-farm payrolls numbers with jobless claims data.

China’s refined aluminium production maintained a steady trajectory in December 2025, reaching a record 3.87 million tons, up 2.9% yoy.

Goldman Sachs lifted its first-half outlook for the light metal to $3,150 a ton from $2,575.

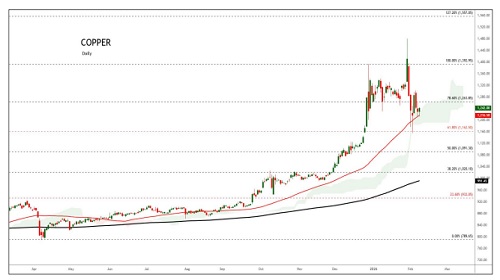

Copper

SELL COPPER FEB @ 1212 SL 1220 TGT 1202-1192. MCX

Observations

Copper trading range for the day is 1165.4-1279.4.

Copper dropped on profit booking after dollar gained amid stronger-than-expected US labor market data

Investors bet on rising demand from global manufacturing, the green transition, and AI, while constrained mine output supports prices.

Goldman Sachs estimates the copper market faced a surplus of 600,000 tons last year, though prices still reached record highs earlier in 2026.

Zinc

SELL ZINC FEB @ 325 SL 328 TGT 322-320. MCX

Observations

Zinc trading range for the day is 315.1-335.1.

Zinc prices dropped on profit booking after prices gained amid persistent concerns of tight supply.

Goldman Sachs expects small global zinc surplus in 2026 Refined zinc production was on track to fall 2% last year, per the latest data, despite the 6.3% jump in mined output