Sell Ambuja Cements Ltd For Target Rs. 432 By Yes Securities Ltd

Strong volume and high incentive led numbers.

Result Synopsis

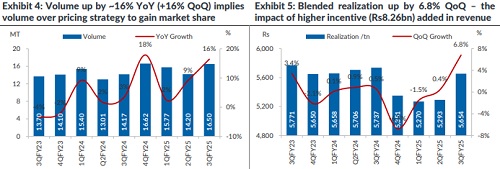

ACL’s consolidated 3Q FY25 numbers were above ours and street estimate due to higher incentive included in revenue numbers supported by strong volumes. If we ignore the one-off incentive figure of Rs8.3bn the numbers are as follows 1). Revenue (+5% YoY/ +13% QoQ) and 2). EBITDA (a fall of 49% YoY and 20% QoQ, while EBITDA/tn down by ~56% YoY (-31% QoQ) to Rs537 vs. the reported EBITDA/tn of Rs1037. The bottom line is, the numbers were pretty good when incentive is added, otherwise it’s not so impressive. We assume the company have chosen, volume over price strategy to hold market share in 3Q. Volumes were up by ~16% YoY (+16% QoQ) whereas cement realizations (Excl. Incentive amount) were down ~3% QoQ which is lowest among all the larger players reported their number so far. And the major portion of incentive have flown from ACC. As per the management the incentive numbers are expected to be Rs6-6.5bn per annum going forward which is vs. Rs4bn earlier.

On consolidated basis, ACL at present capacity of 95mtpa enjoys 15% of market share and expected to reach 20% by FY28. The company is doubling the capacity by FY28 by adding ~45mt of capacity across the demand rich regions though organic and inorganic roots. While recent acquisition with Penna (in southern region), Master Supply Agreement with Sanghi Industry (Western region) and ACC to gain volumes going ahead at lower cost. Also, Orient Cement (in southern region) transaction is expected to conclude soon will have synergy benefits especially logistic and various cost saving benefits. But the real concern is with south based acquired companies i.e., Penna and Orient cement’s capacity utilization and pricing power. Southern region is a oversupply zone where avg. capacity utilization is low in the range of 50-55% with weak pricing. It may take several quarters for Penna cement to achieve ACL’s efficiency level. While its being more than a year, we have not observed any significant improvement at Sanghi Cement. However, the near-term target to have a cost saving of Rs450- 500/tn through various energy, raw-material and logistic cost saving programs likely to result gradual improvement in margins. However, this may take 1.5 to 2 years of time to reflect in the numbers.

Outlook & Valuation: We remain SELL on ACL with certain backdrops such as a). weak pricing in key market regions, b). lower capacity utilization of acquired companies, and c). more than expected time-taking for cost saving programs. We are factoring 12.3% volume CAGR over FY24-FY27E and assuming avg. realization of - 1.9% over FY24-FY27E to arrive Revenue/ EBITDA/ PAT CAGR of 9.5%/ 10%/ 8% over FY24-FY27E. We value ACL at 16x Sep’26 EV/EBITDA to arrive at TP of Rs432 (earlier Rs471). Any significant price hike or strong demand recovery, higher than expected cost reduction are the key upside risk to our assumptions.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632