SBI Banking & Financial Services Fund completes 10 years

Banking & Financial Services Fund, an open-ended equity scheme investing in banking & financial services sector, has completed a milestone of 10 years. The scheme has generated 14.94% return (Direct Plan) and 13.73% return (Regular Plan) since inception (February 26, 2015) vis-à-vis 12.44% of its benchmark Nifty Financial Services TRI. If someone invested a lumpsum of Rs 1 lakh in the scheme when it was launched, the investment would have been worth Rs. 4.03 lakhs (Direct Plan) and Rs. 3.62 lakh (Regular Plan) as on February 26, 2025.

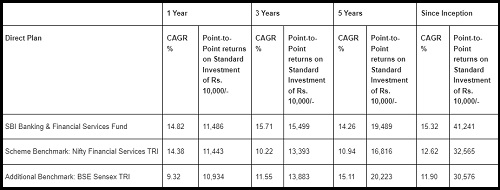

Since its launch on February 26, 2015, the scheme has offered point-to-point CAGR returns of 15.32%, 14.26% in 5 years, 15.71% in 3 years and 14.82% over 1 year. During the same time period the scheme’s benchmark (Nifty Financial Services TRI) delivered 12.62%, 10.94%, 10.22% and 14.38% respectively.

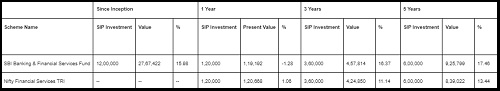

If a monthly SIP would have been made in the scheme of Rs. 10,000 since inception (Rs. 12 lakhs invested), it would be worth Rs. 27.67 lakh as on February 26, 2025, delivering returns of 15.98% CAGR. Similarly, the scheme has delivered returns of 17.46% (5 years) and 16.37% (3 years) vis-à-vis its benchmark Nifty Financial Services TRI returns of 13.44% (5 years) and 11.14% (3 years). The AUM of the scheme stands at Rs. 6,481 crores as on January 31, 2025, and the fund is being managed by Milind Agrawal.

Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment. Period for which scheme’s performance has been provided is computed basis last day of the month-end preceding the date of advertisement. In case, the start/end date of the concerned period is a non-business day, the NAV of the previous date is considered for computation of returns. The performance of the schemes is benchmarked to the Total Return variant of the Index. Wherever NAV/Benchmark Index value is not available for start/end date for concerned period, the previous business day value of NAV/Benchmark Index is considered for return computation. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR of PRI benchmark till the date from which TRI is available. Load is not considered for computation of returns.

Periodical SIP Performances are computed considering SIP Investment on 1st business day of every month. "Since Inception SIP" performance is computed considering 1st instalment on allotment date and thereafter on 1st business day of every subsequent month.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...