Research report on Manthan- Oil & gas by Swarnendu Bhushan, Research Analyst, PLcapital

It’s Belle Epoque^ for the OMCs!

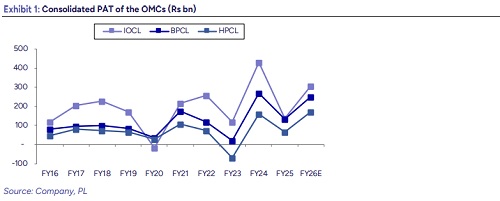

Heightened global geo-political turbulence, depreciating rupee, combined with concerns of excise duty hike and its absorption by the Oil Marketing Companies (OMCs) resulted in their stock prices nosediving by 3-15% over the past month. After all, if history is anything to go by, the OMCs have never made good profits consistently. So, after a handsome FY26E, despite under-recoveries on LPG, would they be allowed to mint in FY27E as well?

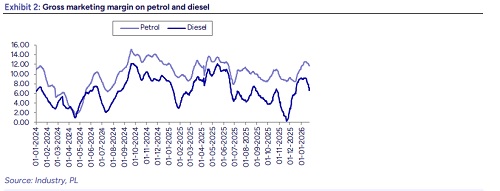

Gross marketing margin on petrol and diesel stand at Rs11.7/lit and Rs6.6/lit currently. If we assume that the impact of Brent at USD65/bbl and Rs/USD at 92 is not getting reflected completely, these would be shaved off by say Rs2-3/lit. Hence, if Brent continues to hover at USD65/bbl, the probability of an excise hike more than Rs2/lit on petrol and diesel is low

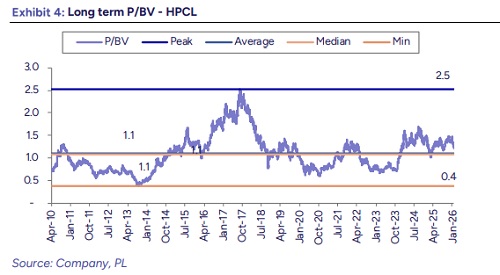

However, post the correction, HPCL for example is trading at ~1x FY28 PBV. At this valuation, considering that no more upward shocks are coming for Brent and excise hike would be on expected lines, we believe that HPCL is enjoying its Belle Epoque and makes for a good buy! Both other stocks are high on capex while HPCL would also have the benefit of reduction in debt as its projects are coming to an end.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271