Reduce Nestle India Ltd For Target Rs. 1,250 By JM Financial Services

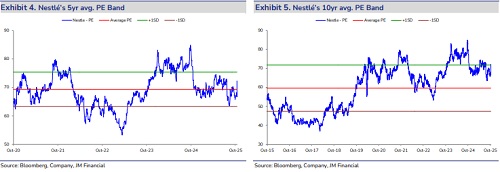

Revenue delivery surprises positively

Nestle India’s 2QFY26 earnings print was ahead of our/Street’s expectation, driven by betterthan-envisaged domestic revenue performance (double-digit growth after 7 quarters). Revenue growth of c.11% was ahead of our/Street estimates by c.5-7%, led by volume growth (we estimate c.7%). Confectionary & beverage continued to clock high double-digit growth. Prepared dishes surprised positively with strong double-digit growth (double-digit volume growth in Noodles) with portfolio intervention showing promising results. Performance in Milk & Milk products remains a mixed bag. Gross margin surprised negatively, down 220bps/70bps YoY/QoQ, impacted by input cost inflation. Commodity outlook is unchanged (expect softening in milk prices post the festive season, continued firmness in edible oil prices, and stabilisation in coffee prices), which, along with operating leverage, should lead to better profitability in 2H (vs. 1H) in our view. Clearly, the execution on revenue line is commendable considering the expectation of GST transition-led disruption in September. We raise our FY27/28 Sales/EBITDA est by c.2%; however, due to higher depreciation and net interest expense, EPS upgrade is marginal. Valuations at 67x/60x FY27/28E adequately capture the positives (earnings CAGR of 15% over FY26-28E). We roll forward to Dec’27E and maintain REDUCE rating with a revised TP of INR 1,250. With leadership change after a decade, the new MD’s strategic directions (on accelerating volumes/extracting cost efficiencies) and disclosure on new growth engines will be the key monitorable.

* Better-than-expected volume drove revenue/earnings beat:

Nestlé’s total sales grew by 10.9% YoY to INR 56.3bn led by strong volume growth, implying high-single-digit volume, much better vs. our expectation of low single digits. Domestic sales grew by 10.8% YoY while exports grew at a faster pace and delivered 14.4% growth YoY. EBITDA grew 6% to INR 12.4bn while adjusted profit declined by 1.9% to INR 7.5bn.

* Double digit growth in Prepared Dishes, Confectionary & Beverages while Milk & Nutrition segment continues to lag:

1) Prepared Dishes and Cooking Aids reported double-digit sales growth driven by double-digit volume growth in MAGGI noodles on the back of uptick in consumption in urban markets (newer launches) and share gains in rural markets (targeted pricing strategies). Pet Food business clocked the highest ever turnover, led by the Cat portfolio. 2) Milk Products and Nutrition witnessed mixed trends with certain segments performing well while others showing muted performance. MILKMAID posted strong growth. 3) Confectionery saw volume-led double-digit growth across KITKAT, MUNCH and MILKYBAR supported by distribution expansion in rural, premiumisation, and increased in-home penetration led by quick commerce. 4) Beverages saw strong double-digit growth with NESCAFÉ portfolio benefiting from improved penetration (due to affordable pricing) and premiumisation (consumer uptrading to NESCAFÉ Gold and Roastery). 5) Out-of-home business posted double-digit growth,

* Gross margin surprises negatively:

Gross margin contracted 220bps YoY to 54.2% (below our estimate of 55.0%) due to high input costs. Staff costs and other expenses grew by 6-7% YoY, lower compared to sales growth. Resultantly, EBITDA grew 6% YoY with margin compression of 105bps to 22% (in line with our estimate). Adjusted PAT was down 2% YoY due to higher depreciation and interest cost. On the commodity front, the management expects milk prices to soften post the festive season with the onset of the flush season and coffee prices to be stable or decrease as the upcoming Vietnam and India crop appears to be normal. Global supply and demand trends for cocoa will remain balanced after demand correction over 2 years. Edible oil prices may remain firm and may see increase due to tight demand-supply at the global level.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361