RBI Policy Preview: Rate Cut Still a Possibility by CareEdge Ratings

December Rate Cut Looks Likely

The upcoming December monetary policy meeting will be shaped by a sharp decline in inflation, a notable pickup in growth momentum, and persistent external headwinds. While the domestic economic environment remains broadly resilient, the continued imposition of higher 50% tariffs on Indian exports to the U.S. amid prolonged trade negotiations is a key concern. Globally, long-term risks stemming from geopolitical conflicts, financial stability concerns from stretched asset valuations, and rising pressure in sovereign bond markets amid elevated borrowing remain important factors to monitor.

However, the RBI is likely to take comfort from the sharp moderation in India’s inflation, which eased to a decadal low of 0.3% in October. The favourable impact of GST rationalisation and deflation in the food and beverages category contributed significantly to the subdued inflation print. We expect inflation to remain below the 4% threshold in both the third and fourth quarters of the fiscal year. Factors such as stable Brent crude prices, healthy reservoir levels supporting rabi sowing, and muted price pressures arising from excess capacity in China should help prevent any sharp rise in inflation. This decline in inflation has created policy space for the RBI to consider rate cuts.

While inflation has been comfortably low, growth momentum has strengthened considerably. The GDP growth accelerated to 8.2% in Q2 after expanding by 7.8% in Q1 FY26. This improvement has been supported by robust agricultural activity, a reduced income tax burden from the previous budget, rationalised GST rates, past RBI rate cuts, an early festive-season boost to consumption, and front-loaded exports. Moreover, the GDP growth was also bolstered statistically by the low base of the previous year and the very low deflator in this period.

Although GDP growth averaged 8% in H1, we expect it to ease to around 7% in H2 as the boost from front-loaded exports fades and post-festival consumption moderates. By Q4 FY26, the impact of the low base will diminish, and the GDP deflator is also expected to rise from its currently depressed levels. For the full year FY26, we project GDP growth at a still healthy 7.5%.

Although GDP growth averaged 8% in H1, we expect it to ease to around 7% in H2 as the boost from front-loaded exports fades and post-festival consumption moderates. By Q4 FY26, the impact of the low base will diminish, and the GDP deflator is also expected to rise from its currently depressed levels. For the full year FY26, we project GDP growth at a still healthy 7.5%.

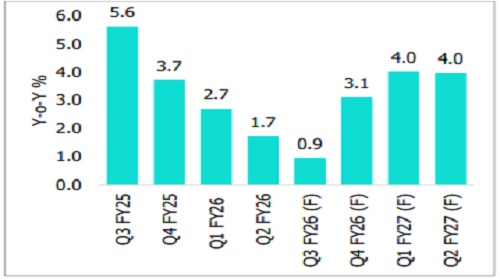

The RBI to Lower Inflation Projection

The CPI inflation continued to stay on a downward trajectory, easing to 0.3% in October 2025. The positive impact of the GST rationalisation and deflation in the food and beverages category supported the lower inflation print. Deflation in the food basket deepened further to 3.7% in October, from 1.4% the previous month. A further acceleration in the already double-digit inflation in precious metals pushed core CPI to 4.4% in October. Excluding precious metals, core CPI inflation was benign at 2.5%. Inflation has likely bottomed out in October, but we estimate it remains benign, averaging 0.9% in Q3 before rising to an average of 3.1% in Q4FY26. Factors such as stable Brent crude prices, GST cuts, healthy reservoir levels supporting rabi sowing, and muted price pressures arising from excess capacity in China should help cap upside in inflation.

Within the food basket of CPI, deflation widened in items such as vegetables (-27.6% YoY), pulses (-16.2%), and spices (-3.3%) in October. While inflation in edible oils witnessed some moderation, it continued to record double-digit inflation at 11.2% capping a further downside in overall food inflation. This trend remains a critical monitorable, particularly as global vegetable oil prices remain elevated, as reflected in the FAO Global Vegetable Oil Price Index, which rose 10.9% YoY in October. Furthermore, Kharif sowing of oilseeds has also been subdued, which could extend inflationary pressures in this category. Overall, we expect food inflation to remain at moderate levels, supported by healthy agricultural activity, comfortable reservior levels and a favourable base. With food inflation subdued, we project an average inflation rate of 2.1% for FY26 and core inflation at 4.1%. RBI revised its CPI inflation forecast for FY26 to 2.6% in October, down from an earlier projection of 3.1%. We expect the RBI to further revise down its inflation projections to around 2.1% in the December policy meeting. Given the low base of FY26, we expect average CPI inflation to be higher, around 4.1% in FY27. Additionally, the forthcoming introduction of the new CPI series with a 2023-24 base year will be an important development to watch.

Exhibit 1: Inflationary Pressures Eased

On the external front, global commodity prices are expected to remain broadly benign, given weak global growth prospects and overcapacity in China. However, it would be crucial to monitor geopolitical developments, such as US-Venezuela tensions and the war in Ukraine. OPEC+ alliance has this week decided to leave output levels unchanged for the first quarter of 2026 amid a looming market surplus and geopolitical uncertainty around Russia and Venezuela. The WPI inflation has remained in deflation in October (-1.2%) and is expected to average -0.1% in FY26.

RBI to Revise Growth Projections

Despite external headwinds, the Indian economy has shown resilience with a strong uptick in growth momentum in the H1. GDP growth accelerated to 8.2% in Q2, after growing 7.8% in Q1 FY26. Healthy agricultural activity, reduction in income tax burden in the previous budget, rationalisation in GST rates, previous RBI rate cuts, early festive season consumption boost, healthy services exports and front-loading of merchandise exports have bolstered the overall economic momentum. Moreover, there is statistical impact of low base of last year, and the low deflator that has pushed up the GDP growth number in Q2. On the expenditure side, growth in private final consumption expenditure accelerated further to 7.9% in Q2 from 7.0% in Q1. Several factors such as reductions in the income tax rate, GST rate rationalisation, and the easing inflationary pressures have boded well for the consumption growth. While rural demand conditions remain steady, a broadbased momentum in the domestic demand scenario remains critical for domestic growth going forward.

While government capex has remained strong led by both states and centre, there are early signs of revival in the capex by the Indian corporations which bode well for the overall investment growth. Major sectors like agriculture (3.5% growth), manufacturing (9.1%), construction (7.2%) and services (9.2%) have shown healthy momentum in Q2. However, the mining sector was impacted by the prolonged monsoon this year.

While, growth remained strong in H1, we expect some moderation in the growth momentum in H2. We expect the GDP growth to moderate to around 7% in H2 (vs 8% in H1) as the impact of front loading of exports fades and consumption demand moderates post festival season. By the fourth quarter of FY26, the low base effect will wane, and deflator will also increase from the current low levels. However, for the full year FY26, we estimate the GDP growth number to remain strong at 7.5%, mainly supported by strong H1 growth. Even with the trade related uncertainties lingering, we expect GDP growth at around 7% in FY27. Given the strong growth performance in H1, the RBI is likely to revise its FY26 growth forecast to around 7.5%, up from the earlier projection of 6.8%.

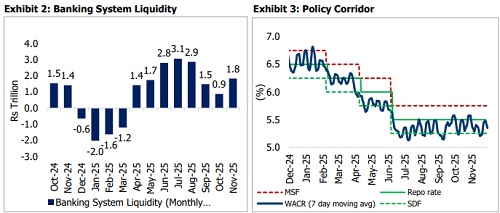

RBI to Support Liquidity Conditions

Currently, the banking system liquidity surplus stands at Rs 2.4 trillion (as of 1st Dec 2025), equivalent to about 0.95% of NDTL. The average systemic liquidity in November 2025 rose to Rs 1.8 trillion from Rs 0.9 trillion in October 2025. The liquidity surplus had narrowed in October amidst tax outflows and the RBI’s intervention in the forex market. However, RBI’s VRR auctions, last tranche of CRR cut (injecting ~Rs 600 billion in end November) and RBI’s OMO purchases in the secondary market (Rs 273 billion as of mid-November) are likely to support liquidity conditions.

With the liquidity support, average call money rate has largely remained below the repo rate in the month of November. We expect the RBI to support liquidity conditions, keeping them in surplus (1-1.5% of NDTL). Surplus liquidity conditions would continue to ensure smoother transmission of the policy rates. We expect that the RBI will continue to ensure favourable money market conditions and support credit growth.

Above views are of the author and not of the website kindly read disclaimer