Economic Pathway for October 2025 by CareEdge Ratings

Global Scenario

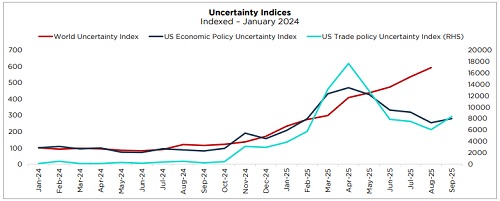

Uncertainties Continue to Cloud the Global Conditions

* Global economic uncertainty remained elevated in August 2025.

* However, US economic and trade policy uncertainty eased from the highs of April-25 as the US entered into trade deals with several economies

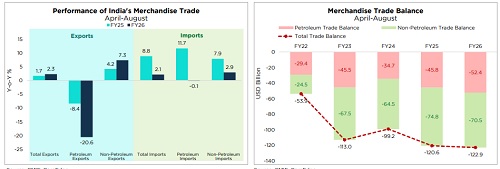

Performance in India’s Merchandise Trade

Non-Petroleum Exports Held Up Well; Merchandise Deficit Rose Slightly Vs Last Year

* India’s non-petroleum exports held up relatively well, rising by 7.3% (y-o-y) in the fiscal year so far; a sharp contraction in petroleum exports weighed on the overall exports.

* Overall imports grew by a modest 2.1% in the fiscal year so far amid a relatively high base of last year.

* Overall, India’s merchandise trade deficit rose slightly to USD 122.9 billion during 5M FY26 on account of a rise in petroleum trade deficit.

* We project India’s merchandise exports to contract by ~4% in FY26; the downside from the 50% US tariffs must be monitored closely.

* Merchandise imports are projected to rise marginally by 0.5% in FY26.

Performance in India’s Merchandise Trade

Electronic & Engineering Goods Supported Growth in Manufacturing Exports

* Manufacturing exports increased by a healthy 8.5% buoyed by encouraging performance in exports of engineering goods (up 5.4%) and electronic goods (up 39.8%).

* Within engineering goods, growth in the fiscal year so far was led by machinery and instruments (up 11.8%) as well as ferrous and non-ferrous metals (up 6.4%).

* The key driver of strong growth in electronic goods was telecom instruments, which recorded a growth of 59% in the fiscal year so far.

* Trade front-loading ahead of tariffs supported India’s export performance so far. The impact of US tariffs on India’s exports going forward remains a critical monitorable.

Performance in India’s Services Trade

Services Trade Surplus Remains Healthy

* India’s services exports grew by 8.7% (y-o-y) during 5M FY26.

* Healthy services exports have aided in the higher trade surplus at USD 80 billion for 5M FY26 compared to USD 68 billion in the same period last year.

* Going ahead, India’s services exports are likely to remain a key support for the external sector. We estimate growth at 8.2% (y-o-y) in FY26, despite some headwinds.

* However, recent developments, such as the increase in H-1B visa fees and lingering global uncertainties, warrant close monitoring.

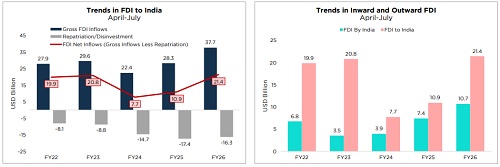

Foreign Direct Investment

FDI Inflows Increased So Far in FY26

* Gross FDI inflows rose 33% (y-o-y) during 4M FY26, while repatriations moderated slightly compared to the year-ago level.

* As a result, FDI net inflows (gross inflows less repatriations) were up by 96% to USD 21.4 billion during 4M FY26.

* Sharp increase in inward FDI translated into net inflows (inflows less outflows) of USD 10.8 billion during 4M FY26, higher than USD 3.5 billion in the comparable period last year

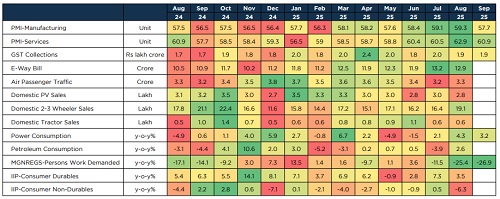

Heatmap on Domestic Economic Activity

Performance in High Frequency Indicators

* PMIs remained in the expansionary zone in September, though with a slight loss in momentum.

* GST collections and generation of e-way bills remained upbeat.

* Weakness in air passenger traffic, domestic sales of passenger vehicles and output of consumer goods signalled some weakness in the demand scenario.

* However, the GST reforms are expected to provide the much-needed boost ahead of the festive season.

RBI Consumer Confidence Survey

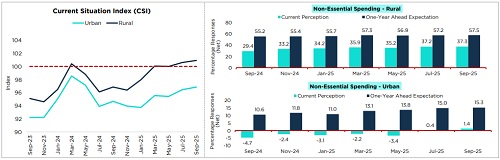

Urban Vs Rural Perceptions

* The current situation index (CSI) for rural as well as urban regions improved marginally in September from July. However, it stayed in the pessimistic zone for urban regions.

* Sentiments around non-essential spending in urban areas, while improving, remained relatively weaker than those in rural regions.

* Going forward, the upcoming festive season, GST rationalisation, income tax reductions, lower food inflation, and RBI rate cuts provide a supportive backdrop for consumption.

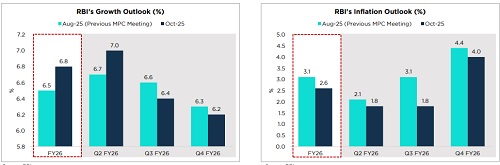

Monetary Policy Committee Outcome

MPC Holds Rates; Ups GDP & Lowers Inflation Forecast

* The MPC kept the policy repo rate unchanged at 5.5% and retained the policy stance at neutral.

* Full-year GDP growth projected at 6.8% by the RBI; We maintain our GDP growth forecast at 6.5% given the global uncertainties.

* While RBI projects a higher GDP growth performance for H1 FY26, H2 growth projection was pared down to 6.3% in October policy from 6.5% earlier amid tariff-related risks.

* RBI has revised its CPI inflation forecast for FY26 down to 2.6% from the earlier projection of 3.1%, amidst GST rationalisation and muted food inflation.

* We project CPI inflation to average at 2.4% in FY26.

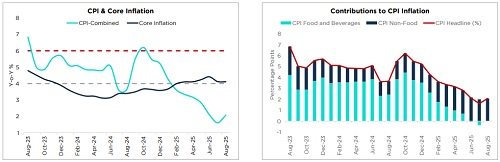

Domestic Inflationary Scenario

India CPI Inflation Rises Slightly but Remains Contained

* CPI inflation rose marginally to 2.1% in August as food prices moved out of deflation but remained benign. Core inflation stayed benign at 4.1%.

* GST rate cuts are expected to lower CPI inflation by 70–90 bps annually, assuming effective pass-through.

* The upcoming introduction of the new CPI series with a 2024 base year will be important to track, as it could alter the estimated impact of GST changes.

* Alongside subdued food prices and contained demand pressures, we project average CPI inflation at 2.4% for FY26

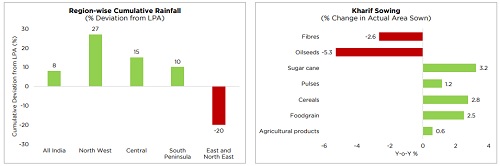

Southwest Monsoon Update

Healthy Kharif Sowing, Though Rainfall Impact Remains a Monitorable

* The Southwest monsoon has performed well, recording 8% above the Long Period Average (LPA) as of the end of September.

* Total sown area rose 0.6% (y-o-y) as of 03 October 2025. However, sowing of oilseeds and fibres remained weak.

* Crop harvest could be delayed with rains continuing in some parts of the country. The impact on agricultural output remains a key watch out.

Bank Credit & Deposit

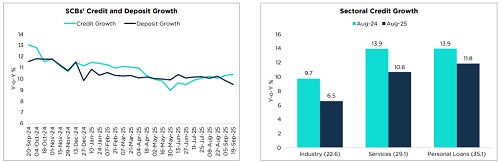

Bank Credit Growth Outpaces Deposit Growth

* Credit growth picked up slightly to 10.4% (y-o-y) as of 19 September, outpacing the deposit growth, which slowed to 9.5% (y-o-y).

* However, bank credit growth remained lower compared to growth of 13% in the same period last year.

* Industrial credit growth was lower at 6.5% as of Aug-25 (Vs 9.7% last year), with credit to large industries moderating to 1.8% from 7.7% in the comparable period.

* Amid moderating credit growth, the RBI has announced multiple measures to improve the flow of credit and promote ease of doing business.

Issuance Calendar of Government of India Dated Securities

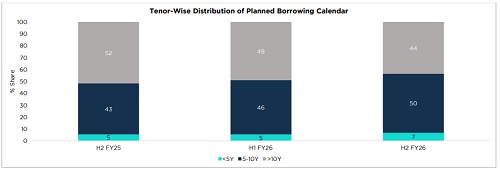

Reduction In Share of Long-tenor Debt

* The government has announced gross market borrowings of Rs 6.8 trillion for H2 FY26. In H1 FY26, actual borrowings stood at Rs 7.9 trillion, slightly below the planned Rs 8 trillion.

* Amid concerns over oversupply of long-tenor debt, the share of securities with maturities above 10 years has been reduced to 44% in H2 FY26, down from the planned 49% in H1 FY26.

Liquidity & G-Sec Yield Update

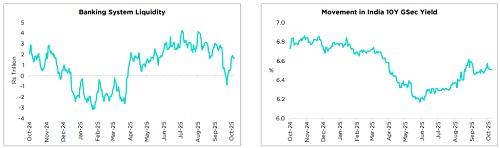

Comfortable Liquidity Surplus; 10Y GSec Yield Reduced

* Banking system liquidity briefly slipped into deficit in late September due to tax outflows but quickly returned to a comfortable surplus. Government month-end spending and the second tranche of the CRR cut on 04 October continue to support liquidity conditions.

* The WACR averaged 10 bps below the policy rate over the past month, reflecting comfortable liquidity conditions.

* India’s 10Y GSec yield remain elevated in spite of the dovish tone of RBI’s MPC.

* Our base case is no further rate cuts, but if the growth scenario worsens with the high reciprocal tariff, we could see a 25-bps rate cut in the December MPC. The easing of inflation outlook, coupled with emerging growth headwinds, has created room for further monetary policy easing.

Trends in FPI

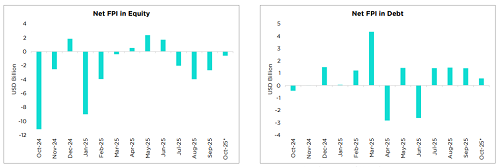

FPI Outflows Continue

* August saw the highest net FPI outflows in four months, at USD 2.3 billion (equity + debt), followed by USD 1.4 billion in September. October has witnessed marginal outflows so far.

* CYTD net FPI outflows (equity + debt) stood at USD 11.9 billion, led by equity outflows of USD 18.2 billion, partly countered by debt inflows of USD 6.3 billion.

* Developments around the US-India trade deal and recent US H-1B visa fee announcement could influence market sentiments and FPI flows.

Currency Update

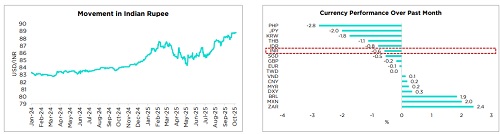

Rupee at Record Lows

* The rupee has depreciated by 0.6% against the dollar over the past month, weighed down by the implementation of US secondary tariffs, the recent announcement of a hike in US H-1B visa fees and persistent FPI outflows.

* We expect the rupee to remain under pressure in the near term. However, the RBI is likely to intervene to limit currency volatility.

* We maintain our FY26-end forecast of 85–87 for USD/INR, supported by a soft dollar, a firm yuan and India’s manageable CAD. The prospects of a US–India trade deal remain uncertain and warrant continued monitoring.

* The dollar index has fallen by 9.6% so far this year, pressured by US trade policy uncertainty, fiscal concerns, and expectations of Fed rate cuts. However, it has gained over the past month due to political uncertainty in France and Japan.

* The Fed lowered its policy rate by 25 bps in September, with the median dot plot now pointing to two more cuts this year, up from one previously. Weak labour market data has strengthened market expectations of further easing.

Above views are of the author and not of the website kindly read disclaimer