Trends & Tides : RBI MPC April 2025 cuts repo rate by 25 bps to 6.00%; Changes stance to `accommodative` by 360 ONE Asset

Benign inflation & moderate growth outlook lead to policy easing

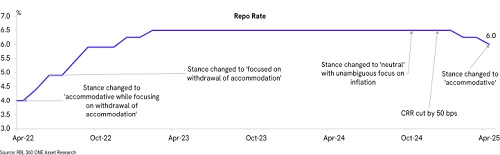

RBI MPC changes the policy stance to 'accommodative' from 'neutral' as focus shifts to growth

The RBI Monetary Policy Committee (MPC) decides to reduce the policy repo rate by 25 basis points to 6.00% from 6.25%

The MPC changes the policy stance to 'accommodative' from 'neutral'

The monetary policy statement notes that there is a decisive improvement in the inflation outlook and there is now a greater confidence of a durable alignment of headline inflation with the target

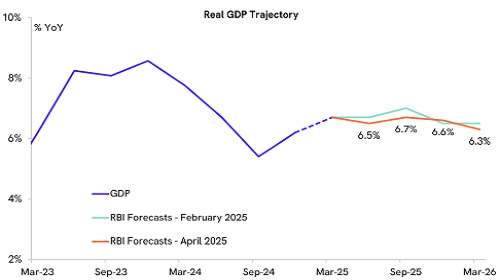

However, the growth is still on the recovery path, impeded by a challenging global environment and high uncertainties due to a surge in global volatility

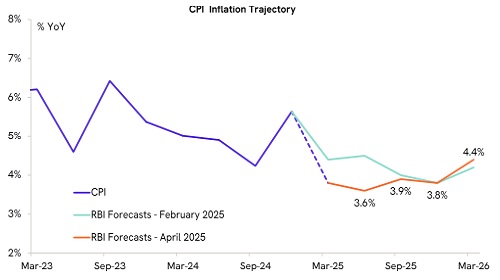

RBI projects CPI inflation for FY26 at 4% YoY, down from 4.2% in Feb'25 policy

The outlook for food inflation has turned decisively positive, with a broad-based seasonal correction in vegetable prices

RBI inflation outlook

The uncertainties on rabi crops have abated considerably

The second advance estimates point to a record wheat production and higher production of key pulses over the last year

The sharp decline in inflation expectations for three-months and one-year ahead period would help anchor inflation expectations

The fall in crude oil prices augurs well for the inflation outlook

Concerns on lingering global market uncertainties and the recurrence of adverse weather-related supply disruptions pose upside risks to the inflation trajectory

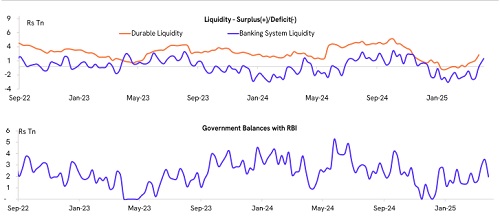

RBI appears to be aiming to maintain liquidity conditions in surplus

Surplus liquidity conditions will help improve the transmission of rate cuts to credit and deposit markets

Outlook: We expect the RBI to cut rates by a further 25 bps in the June policy

The inflation outlook appears favourable, while growth risks have intensified amid increasing economic uncertainty

Above views are of the author and not of the website kindly read disclaimer