2025-04-01 04:23:54 pm | Source: LKP securities Ltd

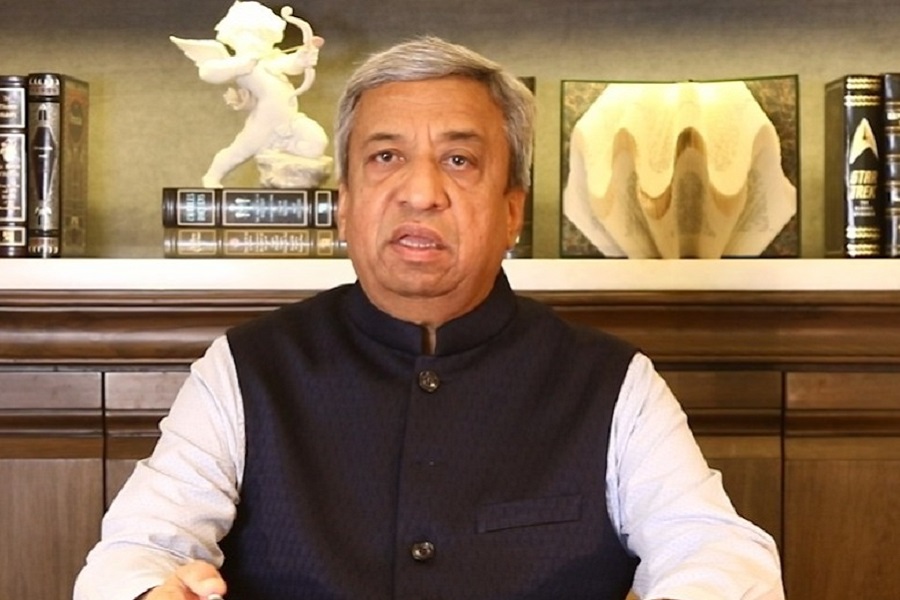

Quote on Gold by Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

Below the Quote on Gold by Jateen Trivedi, VP Research Analyst - Commodity and Currency, LKP Securities

"Gold prices witnessed minor profit booking in the morning session as market participants took a cautious approach ahead of tomorrow’s major announcement on reciprocal tariffs from the US. With gold already factoring in most of the tariff-related moves, any delay or lower-than-expected tariffs could trigger further profit booking. On MCX, gold registered a fresh all-time high of ?91,400 in the June contract, marking an impressive 18% gain in 2025 so far. The week ahead remains highly volatile, with a trading range projected between ?88,500-?92,500. Additionally, key economic data, including Manufacturing and Services PMI, ADP unemployment, Nonfarm Payrolls, and US Unemployment data, will keep traders on edge, influencing gold’s movement further."

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Gold trading range for the day is 155390-167760 - Ke...

Haryana expected to see 13.17 lakh metric tons mustard

Hotel industry in India likely to grow up to 12 pc i...

Sell EURINR MAR @ 107.8 SL 108.1 TGT 107.5-107.3 - K...

Indian rupee may slide past 92 to record low as Mide...

Wall Street likely to open 2.5 pc lower as Middle Ea...

.jpg)

Morning Glance - 03rd March 2026 - ARETE Securities Ltd

Dollar firms, euro under pressure as energy prices s...

Oil prices jump nearly 5%, settle at highest since J...

Pre-market comment for Wednesday March 4 by Aakash S...