Q1FY26 Quarterly Results Review by Choice Institutional Equities

Executive Summary

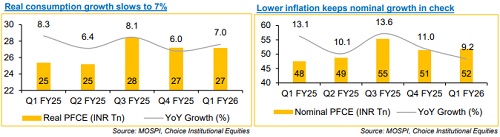

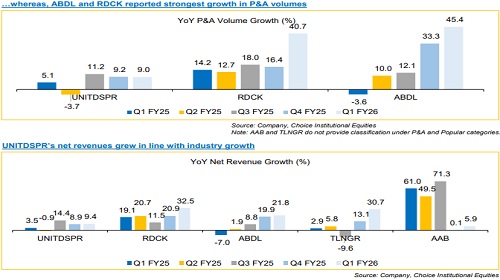

* In Q1 FY26, Private Final Consumption Expenditure (PFCE) growth slid on both, real and nominal, terms, signalling a slowdown, while premiumization was evident in rising Prestige & Above (P&A) volumes

* Maharashtra steeply hiked excise on IMFL and Premium IMFL categories, negatively impacting prices for a month in Q1. The impact on Q2 is yet to be ascertained. As an alternative, a lowerduty, grain-based Maharashtra Made Liquor (MML) category has been introduced, which is produced and sold locally

* Meanwhile, Delhi extended its previous excise policy for nine months, while Telangana’s payment cycle normalisation provided regulatory tailwinds

* We expect AlcoBev companies to sustain growth through FY26, supported by sector tailwinds and the upcoming festive season

Our Long-term Investment Ideas

Radico Khaitan Limited (RDCK)

CMP: INR 2,840 | TP: INR 3,340 | Rating: BUY | Upside: 17.6%

Investment Thesis:

* Well-established Portfolio Set To Drive Growth

* Distribution Scale Positions RDCK Among the Market Leaders

* Backward Integration Complete: Awaiting margin expansion

Allied Blenders & Distillers Limited (ABDL)

CMP: 494 | TP: INR 590 | Rating: ADD | Upside: 19.4%

Investment Thesis:

* Portfolio Transformation Unlocks Premium Growth

* Strong Distribution Network Providing A Springboard For Brand Launches

* Margin Expansion To Continue With Vertical Integration

Tilaknagar Industries Limited (TLNGR)

CMP: INR 460 | TP: INR 650 | Rating: BUY | Upside : 41.4%

Investment Thesis:

* Imperial Entry: TLNGR’s Royal Leap Beyond Brandy

* Brandy Dominance And Strategic Partnerships

* From Survival To Growth Investment – Financial Turnaround

Associated Alcohols & Breweries Limited (AAB)

CMP: INR 1,002 | TP: INR 1,300 | Rating: BUY | Upside: 29.7%

Investment Thesis:

* From Grain to Glass: Operational Leverage Through Integration

* Path To Premium: Multi-state Expansion As a Growth Catalyst

* Stable Cash flows Powering Self-Funded Growth

PFCE growth slows down; Mass consumption affected

* For Q1FY26, PFCE growth slowed down, from 8.3% a year ago to 7%, indicating slowdown in mass consumption

* However, Luxury and Premium segments sustained strong performance, reinforcing the premiumization trend highlighted in our AlcoBev Thematic (Read here).

* Possible catalysts for growth in consumption are – the GST rate rationalisation and the onset of the festive season in Q3 FY26E

* With an increase in P&A launches, we project sustained sector growth as these new brands gain traction

Pernod Ricard business update (FY ended 30th June, 2025)

* In FY25, Pernod Ricard India delivered a 6% organic net sales, contributing 13% to global net sales, with premiumization driving +8% growth, excluding Imperial Blue.

* Royal Stag and international brands, led by Jameson, delivered a double-digit growth.

* The Imperial Blue divestment is set to accelerate premiumization, although Maharashtra’s excise policy changes is feared to pose nearterm headwinds in FY26.

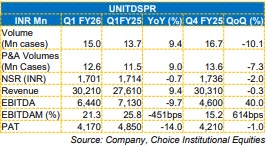

Q1 FY26: Performance Analysis

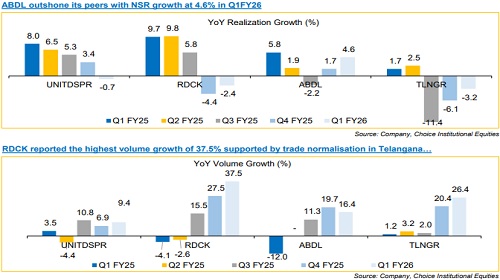

* UNITDSPR is likely to be constrained to industry-level growth amid state policy headwinds.

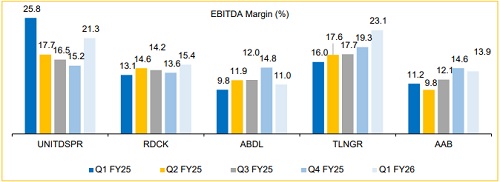

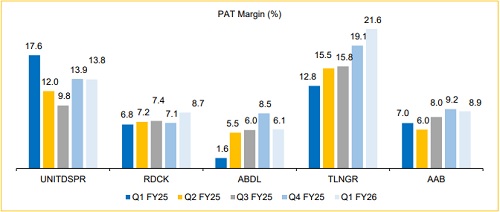

* UNITDSPR reported a net revenue of INR 30.2Bn, posting a growth of 9.4% YoY, while EBIDTA came in at INR 6.4Bn, a decline of 9.7% YoY, mainly due to one-off indirect tax of INR 0.43Bn in Q1FY26.

• We forecast revenue / EBITDA / PAT to grow by 11.8% / 16.1% / 11.3% for FY26E.

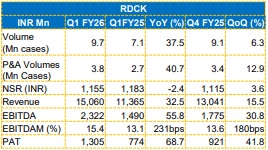

* RDCK’s Q1 growth was led by 37.5% rise in volumes, while Prestige & Above grew faster by 40%

* Meanwhile, it also experienced regulatory tailwinds, driving market share gains in key states

* It posted a net revenue of INR 15.1Bn, up 32.5% YoY, while EBITDA stood at INR 2.3Bn, up 55.8% YoY, in Q1FY26

* We forecast revenue / EBITDA / PAT to grow by 24.9% / 36.9% / 59% for FY26E.

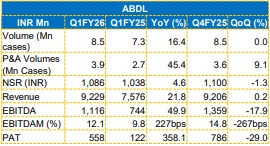

* ABDL saw a robust increase in volume of 16.4% YoY to 8.5 Mn cases, with NSR reaching INR 1,086 in Q1FY26

* The P&A portfolio showed 46.9% volume growth in Q1FY26

* It posted a net revenue of INR 9.3Bn, up 21.8% YoY. Meanwhile, EBITDA saw an increase by 49.9% YoY to INR 1.1Bn, Q1FY26

* We forecast revenue / EBITDA / PAT of 14.1% / 19.2% / 25.6% for FY26E.

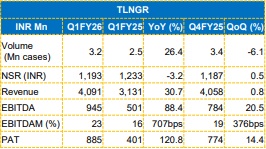

* TLNGR’s INR 41.2Bn Imperial Blue acquisition, to be completed in six months, will bring pan-India reach and is expected to be cash EPS accretive

* It will expand TLNGR’s subsidiary Prag’s bottling capacity six-fold to 36 lakh cases annually within the next year

* TLNGR posted a net revenue of INR 4,091Mn, up 30.7% YoY, while EBITDA grew by 88.4% YoY to INR 945Mn, in Q1FY26

* We forecast revenue / EBITDA / PAT to grow by 46% / 32% / -31.7% for FY26E

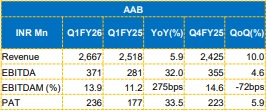

* AAB’s Q1 growth was led by Central Province Vodka, which gained 5–6% share in Madhya Pradesh.

* Hillfort and Nicobar saw volumes of ~2,000–2,500 cases.

* AAB posted a net revenue of INR 2.7Bn, up 5.9 YoY, while EBITDA stood at 371Mn, up 32% YoY, in Q1FY26

* We forecast revenue / EBITDA / PAT to grow by 10% / 13.7% / 8.4% for FY26E

Quarterly Trend Analysis

Quarterly Trend Analysis

TLNGR led EBITDA margin, the highest in last 5 quarters

PAT margin leadership concentrated in TLNGR and UNITDSPR

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

.jpg)