Pre Budget Expectation on FY27E fiscal deficit at 4.2% by Garima Kapoor ,Elara Capital

Expect FY27E fiscal deficit at 4.2%

Union Budget FY27E is set to emphasize the government’s role as a capex enabler from a capex spender. The government of India is transitioning toward a greater role as a policy enabler to facilitate private sector investment (New Labor codes, GST rate rationalization SHANTI Bill, The Merchant’s Shipping Bill, change in definition for MSME), while moderating the pace of its direct capital expenditure that dominated post-COVID recovery (public infrastructure foundations – roads, railways – are now more mature). We expect the Union Budget FY27E to continue on this path. We pencil in a growth of 9.5-10% in capital expenditure in FY27E (10.1% in FY26BE vs FY25RE) with defence and 50-year interest free loans to states recording more than 20% increase versus FY26E levels.

|

Expect FY27E fiscal deficit at 4.2% Union Budget FY27E is set to emphasize the government’s role as a capex enabler from a capex spender. The government of India is transitioning toward a greater role as a policy enabler to facilitate private sector investment (New Labor codes, GST rate rationalization SHANTI Bill, The Merchant’s Shipping Bill, change in definition for MSME), while moderating the pace of its direct capital expenditure that dominated post-COVID recovery (public infrastructure foundations – roads, railways – are now more mature). We expect the Union Budget FY27E to continue on this path. We pencil in a growth of 9.5-10% in capital expenditure in FY27E (10.1% in FY26BE vs FY25RE) with defence and 50-year interest free loans to states recording more than 20% increase versus FY26E levels.

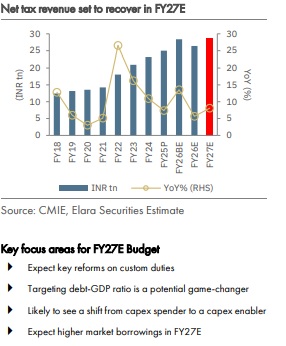

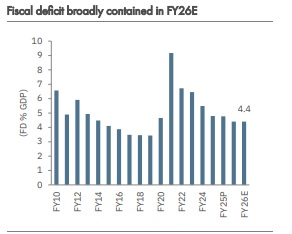

As government opens to trade, customs duty rationalization imperative: With geopolitical uncertainty reshaping global supply chains, a simpler and more predictable customs framework could materially enhance the competitiveness of exports and improve FTA effectiveness, without posing meaningful fiscal risks. A fragmented duty structure with eight slabs, multiple exemptions and overlapping levies adds to compliance complexity and increases the scope for classification disputes. Although India has signed several FTAs, related utilization remains limited due to extensive documentation requirements, stringent rules of origin and post-clearance audit risks. The Government should address these challenges in the upcoming Union Budget FY27. Shift to debt-to-GDP anchors allows modest fiscal consolidation, expect FY27E fiscal deficit at 4.2%: As the government shifts from point targeting of the fiscal deficit to a debt-to-GDP anchor, we expect the modest pace of fiscal deficit consolidation to moderate hereon. If the Centre wants to reduce the debt-to-GDP to below 50% by FY31 from ~55% currently, and assuming a nominal GDP growth of 10% each year, the pace of consolidation required hereon till FY31E would be 40-50bps only. This should provide room for expenditure growth of ~8% YoY; led by revenue expenditure at 7.5% and capital expenditure of 9.5%, translating into fiscal deficit of 4.2% in FY27E versus 4.4% in FY26E. Net tax revenue set to improve in FY27E: A recovery in nominal GDP growth should aid tax collections, especially corporate and indirect taxes. Also, recent excise duty hike in cigarettes and tobacco products and likely hike in petrol and diesel may help garner additional revenue. We project overall net tax growth of 8.1% in FY27E versus 3.2% in FY26E and 11% in FY26BE. Expect the momentum of non-tax revenue to be retained in FY27E and see a growth of 15%. We budget additional INR 150bn from higher excise duty on cigarettes. Government to meet fiscal deficit target of 4.4% in FY26E: We expect the Central government’s fiscal deficit to print at 4.4% of GDP, in line with the budgeted target, as shortfall in receipts is offset by expenditure compression. Weak net tax collections in FY26 weighed on overall revenue collections. Given the lower drawdown of funds by the Ministry of Finance and the absence of new capex schemes announced during the year, we see limited scope for full utilization of the budgeted capex allocation, implying a shortfall of ~INR 400bn versus BE. Yields to remain firm: As fiscal policy globally takes dominance over monetary policy and Japanese yields remain under pressure, we see domestic yields staying firm. JGB 10y yield has 30% positive correlation with IGB 10y for the past two decades. Domestically, the consolidated net borrowing by centre plus states is expected to increase to INR 21.47tn from INR 20.24tn, assuming INR 865bn of back-to-back GST loans maturing in April 2026, funded by amount in compensation cess fund and ~INR 1tn worth buybacks. As demand from Provident Fund rises amid new rules of salary structure under new labour codes (50% of basic pay), the demand for bonds may see some improvement. We expect India 10-year yield to remain firm and trade in the range of 6.7-7% through FY27E versus 6.6% at present. |

Please refer disclaimer at Report

SEBI Registration number is INH000000933.