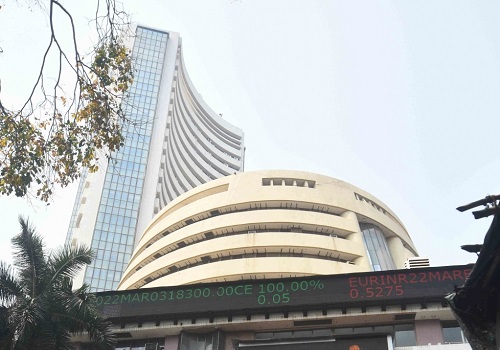

Opening Bell : Markets likely to extend previous session`s losses with negative start

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Indian markets ended sharply lower on Thursday after the Reserve Bank of India's decision to keep repo rate steady with no guidance on rate cut, put pressure on private bank stocks. Today, markets are likely to extend their previous session’s losses with negative start amid as rate cut hopes get delayed post RBI's policy meeting yesterday. Oil prices gained more than 3 percent overnight likely to dent sentiments. Oil prices rose on concerns of a broadening conflict in the Middle East after Israel rejected a ceasefire offer from Hamas. Also, foreign fund outflows likely to dampen sentiments in the domestic markets. Provisional data from the NSE showed that foreign institutional investors (FIIs) net sold shares worth Rs 4,933.78 crore on February 8. However, some support may come later in the day the Reserve Bank of India’s (RBI) consumer confidence survey showed that the households expect improvements in general economic and employment conditions to continue over the next one year. Traders may take note of Rural Development Minister Giriraj Singh’s statement that digitisation of land records and registration is expected to improve the GDP of the country by about 1.5 per cent. There will be some buzz in railways related stocks as following the interim budget announcement of 434 railway track expansion projects, the Union Cabinet Committee on Economic Affairs approved six multi-tracking projects of the Ministry of Railways with an estimated cost of Rs 12,343 crore. Telecom stocks will be in focus as the Cabinet approved the next spectrum auctions set to be held later this year with a reserve price of Rs 96,317 crore. All the available spectrum in 800, 900, 1800, 2100, 2300, 2500, 3300 megahertz (MHz) and 26 gigahertz (GHz) bands will be put to auction. There will be some reaction in coal industry stocks as India's Coal production has surged to 803.79 MT for FY 2023-24 as on February 6th, 2024, showcasing a notable increase from the 717.23 MT recorded during the corresponding period of FY 2022-23, reflecting an impressive growth rate of 12.07%. Amid stock-specific action, shares of RVNL, LIC, IRCON will be in limelight as investors react to their Q3 results. LIC's Q3 standalone profit grew 49 per cent YoY to Rs 9,444 crore. Investors likely to keep close eye on earnings of many companies to be out later in the day.

The US markets ended higher on Thursday as investors reacted to earnings reports and U.S. jobs data, and the US dollar gained. Asian markets are mostly closed on Friday as the region enters the Lunar New Year holiday period. China, South Korea and Taiwan's markets will be shut, while Singapore and Hong Kong will see a half day of trading.

Back home, Indian equity markets ended sharply lower on Thursday amid selling pressure in a majority of rate-sensitive stocks, following the Reserve Bank of India's (RBI) decision to keep its key interest rate unchanged for a sixth consecutive meeting, in line with expectations. Weekly expiry of F&O contracts also added to the volatility of Dalal Street. Markets made an optimistic start of the day. Traders got some support as responding to concerns about inflation, Finance Minister Nirmala Sitharaman underscored a reduction in core inflation, which decreased from 5.1 percent in April 2023 to 3.8 percent in December 2023, signaling improved economic resilience. Some support also came with Commerce and Industry Minister Piyush Goyal’s statement that the government has set up a task force under the Department of Commerce to identify, categorise and develop tailored strategies for the resolution of non-tariff barriers. However, key gauges erased initial gains and slipped sharply into red in late morning deals, as the provisional data from the NSE showed foreign institutional investors (FIIs) net sold shares worth Rs 1,691.02 crore on February 7, 2024. Selling further crept in as the Department of Financial Services (DFS) secretary Vivek Joshi said that India’s bad bank or the National Asset Reconstruction Company (NARCL) has not made much progress but aims to take on Rs 2 lakh crore of banks’ stressed or non-performing assets (NPAs) by the end of FY25. Traders overlooked the International Energy Agency’s (IEA) report stating that India will emerge as the largest source of global oil demand growth between now and 2030, signaling a significant shift in the dynamics of the global oil market. Finally, the BSE Sensex fell 723.57 points or 1.00% to 71,428.43 and the CNX Nifty was down by 212.55 points or 0.97% to 21,717.95.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Daily Market Analysis : Markets traded in a volatile range and ended largely flat, pausing a...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">