Nifty surged past critical resistance, crossing its 50-day exponential moving average (DEMA) and breaking above a `Doji` candlestick high in a single session - Tradebulls Securities Pvt Ltd

Nifty surged past critical resistance, crossing its 50-day exponential moving average (DEMA) and breaking above a ‘Doji’ candlestick high in a single session. This decisive breakout, backed by strong volumes, ended a two-day consolidation range and expanded the trading spectrum, forcing options writers to adjust positions. Technical indicators reinforce the bullish outlook. The daily Relative Strength Index (RSI) is trending upward, reflecting strengthening momentum. Simultaneously, the Average Directional Index (ADX) has turned positive, with the +DI crossing 30 and ADX holding above 25, indicating a sustained trend. Adding to this, a bullish crossover between the 5-day and 20-day DEMA suggests further gains are likely as the price action catches up with momentum. Option data points to an immediate range of 24,400–25,000, with 24,700 acting as a pivotal level. A breakout above 24,940 could drive Nifty to test 25,120 in the near term, with an extended target of 25,570 in sight. Traders should maintain leverage long positions above 24,110 and consider adding further once 25,120 is decisively cleared. Investors are advised to accumulate during consolidations while keeping a revised weekly stop-loss at 23,600. With robust volumes and supportive technical indicators, Nifty appears set for continued upside, offering lucrative opportunities for both traders and investors in the current rally.

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838

.jpg)

.jpg)

.jpg)

.jpg)

Tag News

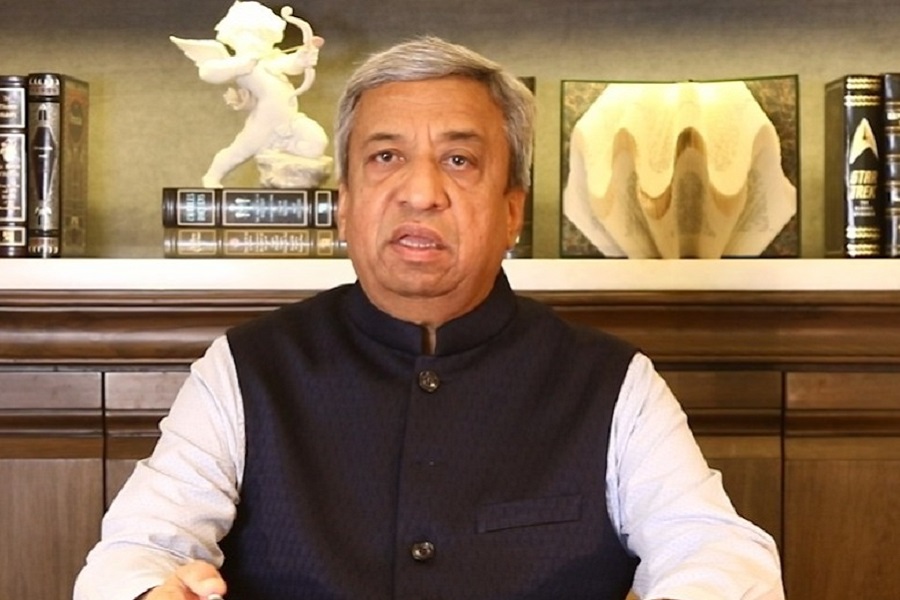

Quote On Post market comment by Mandar Bhojane, Research Analyst, Choice Broking

More News

Quote on Nifty by Rupak De, Senior Technical Analyst at LKP Securities