Nifty & Bank Nifty Weekly Outlook 06 July 2025 by Choice Broking Ltd

NIFTY WEEKLY OUTLOOK

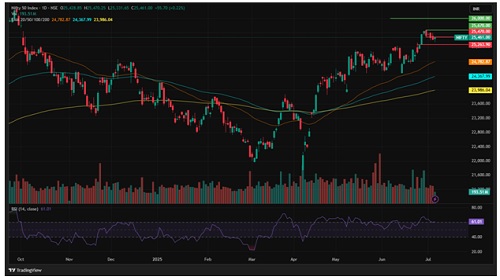

Markets ended the week on a positive note despite a largely rangebound trading environment. The Nifty closed at 25,461, up 55.7 points, while the Sensex added 193 points to end at 83,432. The broader market saw support from key sectors like banking, pharma, IT, realty, oil & gas, and media, which posted gains between 0.4% and 1%. However, metals, telecom, and auto stocks underperformed, limiting the overall upside.

Investor sentiment remains cautiously optimistic ahead of the anticipated US-India trade agreement, with the tariff deadline drawing closer. A favorable outcome from the talks could act as a major trigger for the next phase of the rally, especially given the recent lack of directional momentum. This event is being closely tracked by institutional participants and could determine the near-term trend.

From a technical standpoint, the Nifty has resumed its upward trajectory after breaking out of its recent consolidation range. The index is currently in Wave 5 of an Elliott Impulse structure on the weekly chart, indicating a continuation of the bullish trend. As per Fibonacci extension, the next major upside targets are seen at 27,300 and 28,600. On the downside, key supports are placed at 25,000 and 24,500, where buying interest is likely to emerge. The rising RSI at 64.58 further validates the strength of the ongoing momentum.

Support Levels: 25200-25000

Resistance Levels: 26000-26200

Overall Bias: Bullish

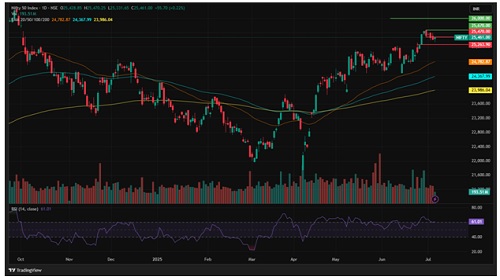

BANKNIFTY

The Bank Nifty index closed at 57,031.90, registering a 0.72% decline from the previous week's close. The weekly chart indicates rejection at higher levels; however, the index has managed to hold above the crucial 57,000 mark. The selling pressure at higher levels suggests a potential pause in the ongoing uptrend, indicating a likely sideways phase in the near term.

This week, the Bank Nifty index formed a bearish-bodied candle with a slight lower wick, supported by consistent trading volumes. This reflects sustained selling pressure and limited buying interest at higher levels, indicating the potential for consolidation or a mild corrective phase in the near term. However, as long as the index holds above the 56,500 support level, a "buy on dips" strategy remains favorable, with upside targets placed at 57,300 and 57,500.

On the weekly timeframe, Bank Nifty is trading above all its key moving averages, including the short-term 20-day, medium-term 50-day, and long-term 200-day Exponential Moving Averages (EMA), indicating an overall upward trend. However, selling pressure at higher levels suggests that a consolidation phase is underway, with the index attempting to hold above the crucial 57,000 mark. Key downside support is seen in the 56,700–56,500 range. The Relative Strength Index (RSI) stands at 65.39, indicating a sideways move. This consolidation phase may lead to either a time-wise or price-wise correction as the index awaits fresh triggers for the next directional move.

The Bank Nifty index is likely to face significant resistance in the 57,300–57,500 range. If the index continues to move higher, ICICIBANK from the private banking sector is expected to support the uptrend. Similarly, in the public sector banking space, SBIN and CANBK are anticipated to show strength.

For the ongoing expiry, put options show the highest concentration near the 57,000 and 56,500 strikes, marking these as key support levels. Conversely, significant open interest in call options at 57,000 and 57,500 indicates potential resistance, suggesting a likely trading range of 56,500–57,500 in the upcoming sessions. Traders are advised to remain cautious, consider a buy-on-dips approach, and maintain strict stop-loss levels to manage risks effectively amid ongoing market volatility and potential price fluctuations.

Support: 56700-56500

Resistance: 57300-57500

Bias- Sideways

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131