Nifty 50 witnessed a sharp decline after attempting to engulf its prior three-day up-move in a single session - Tradebulls Securities Pvt Ltd

_Securities_(600x400).jpg)

Nifty

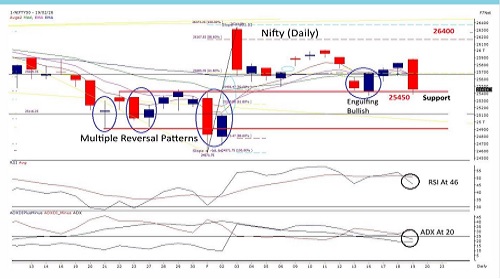

Nifty 50 witnessed a sharp decline after attempting to engulf its prior three-day up-move in a single session. Sentiment turned negative amid heightened geopolitical tensions surrounding the US–Iran conflict, which triggered a sharp spike in crude oil futures. The bullish undertone was jeopardized as the index failed to attract buying support and slipped below the immediate swing support of 25640, accelerating the decline. However, by the close, the index managed to defend its major demand zone around 25400. Earlier this week, Nifty had successfully protected this crucial pivot by forming a clear Bullish Engulfing pattern on the daily chart, with subsequent follow-through confirming it as a strong demand base. A decisive breach below 25400 could result in further downside toward the 25040 support, while on the upside, the convergence of multiple averages near 25670 now stands as a key hurdle for any immediate relief rally. The extremely low OI-PCR of 0.56 remains the only supportive factor for a short-term bounce in today’s session. Technically, as long as the index sustains above 25400 and more tactically above 25640 on a weekly closing basis the broader bullish structure remains intact. However, a clear break below 25400 would negate the positive setup. Fresh aggressive long positions are advisable only on a breakout above 25750, which could reignite momentum and open the path toward the 26000–26400 zone

Please refer disclaimer at https://www.tradebulls.in/disclaimer

SEBI Registration number is INZ000171838